Wise Is Shutting Down Accounts Linked To Crypto Activities: A Detailed Analysis

Wise, formerly known as TransferWise, has recently been in the spotlight for its decision to shut down accounts linked to cryptocurrency-related activities. This move marks a significant shift in the fintech company’s stance towards the crypto sphere, reflecting broader concerns about regulatory compliance and the reputational risks associated with cryptocurrencies.

Understanding Wise’s Decision

Wise has built its reputation on providing streamlined, cost-effective international money transfers, serving millions of customers worldwide. The decision to close accounts associated with cryptocurrency comes at a time when the global regulatory landscape regarding digital currencies is becoming increasingly stringent.

According to sources within Wise, the decision was primarily driven by the need to comply with evolving financial regulations and anti-money laundering (AML) standards. Cryptocurrencies, despite their growing mainstream acceptance, are often associated with high risks, including potential involvement in illegal activities such as money laundering and terrorism financing.

Impact on Customers

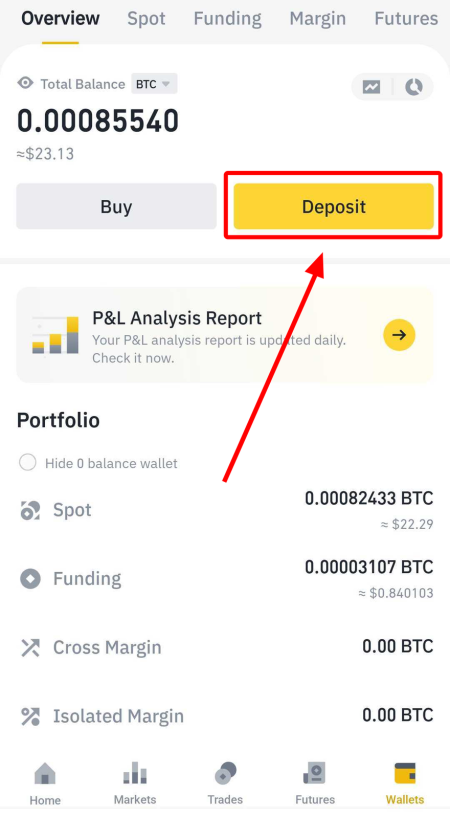

This policy change has significant implications for Wise customers who engage in cryptocurrency transactions, whether for investment purposes or as a means of payment. Users who have been identified as dealing in cryptocurrencies through their Wise accounts have reportedly received notices informing them of account closure, giving them a short window to withdraw their funds and find alternative banking solutions.

The suddenness of account closures has led to customer backlash, with many expressing frustration over what they perceive as a lack of transparent communication and adequate support from Wise during the transition. The decision also raises questions about the freedom and privacy of consumers who legally engage in cryptocurrency transactions.

Broader Implications for the Fintech and Crypto Industries

Wise’s move could set a precedent for other fintech companies, especially those struggling to balance innovation with regulatory compliance. As governments around the world tighten regulations on cryptocurrencies, fintechs face the difficult choice of either enhancing their compliance mechanisms or scaling back their involvement with high-risk sectors.

For the cryptocurrency industry, actions like those taken by Wise reflect ongoing challenges in gaining full acceptance within the traditional financial system. Such developments could potentially slow the rate of cryptocurrency adoption or push these activities to less regulated, more privacy-focused platforms.

Looking Forward

As Wise continues to navigate the complex regulatory environments of the numerous countries in which it operates, its actions may encourage or necessitate similar moves by other financial institutions. For the broader fintech sector, the focus may shift increasingly towards developing more robust AML and compliance frameworks to accommodate, rather than resist, the integration of cryptocurrencies.

Moreover, the reaction from the crypto community and from regulatory bodies will likely influence future policies. If the backlash is strong enough, Wise and similar companies may need to reconsider their stance and offer more tailored solutions that can securely accommodate the needs of crypto enthusiasts.

Conclusion

Wise’s decision to shut down accounts linked to crypto activities highlights the growing pains of an industry at the intersection of traditional finance and innovative digital technology. As cryptocurrencies continue to evolve, the tension between technological possibilities and regulatory necessities becomes more pronounced. The outcome of this tension will significantly shape the future landscape of both fintech and crypto industries, determining how or if they can synergistically coexist.