In a stunning turn of events that has left the cryptocurrency community in shock, Bitcoin witnessed a massive liquidation event, resulting in approximately $740 million being wiped out from the market. This unforeseen event raises critical questions about the health and stability of the cryptocurrency market, particularly around the issues of leverage and speculative trading.

The Leveraged Buildup

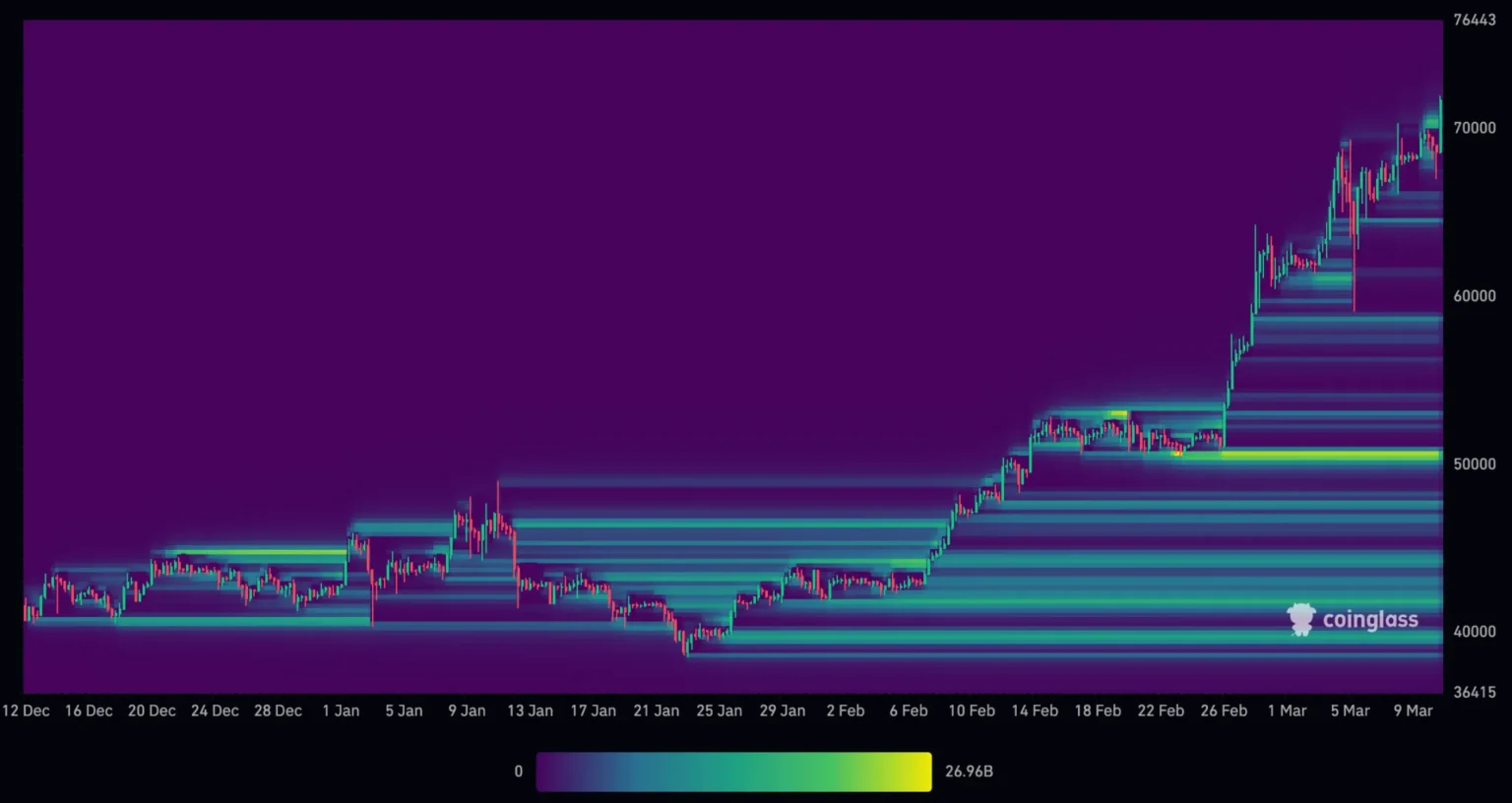

Prior to the plummet, there was a noticeable buildup of leveraged positions in the market. Traders, anticipating a bullish market movement, possibly fueled by the positive sentiments in the global economy or by specific developments in the crypto space like technological advancements or regulatory news, had increasingly been taking on large amounts of leverage to maximize potential profits. Leverage in the crypto markets allows investors to borrow money to increase their investment size, aiming to amplify returns. However, this comes with a higher risk of liquidation if the market moves against their position.

The Trigger and Massive Liquidation

The trigger for the mass liquidation appears to be a sudden, sharp decline in Bitcoin prices, which could have been catalyzed by a variety of factors such as market rumors, substantial sell orders by large holders, or negative regulatory news. This price dip resulted in a cascading effect where the leveraged positions began to unwind rapidly. As prices dropped, automatic liquidation triggers (stop-loss orders) were activated, further pushing the price downward in a vicious cycle.

Impact on the Market

This liquidation event has significant implications for the market. Firstly, it led to a sharp decline in Bitcoin prices, which not only affects investors’ portfolios but also the overall market sentiment. Bearish trends can often lead to a loss of public confidence in cryptocurrencies as viable investments.

Furthermore, large liquidations can stress cryptocurrency exchanges, some of which may struggle with liquidity during such events, potentially leading to delayed withdrawals or even temporary halts in trading. Moreover, such events can attract regulatory scrutiny as authorities aim to protect investors from volatile markets and ensure stability.

Clearing the Leverage Overhang

An interesting perspective on such massive liquidations is whether they effectively clear the leverage overhang in the Bitcoin market. Leverage overhang refers to the precarious buildup of borrowed money in the market, which can lead to high volatility and instability. By liquidating over-leveraged positions, the market might return to a more stable, organic state, based less on speculative trading and more on fundamental values and utility.

While painful in the short term, such corrections can be healthy for the market in the long run. They discourage excessive speculative behavior and can lead to more sustainable growth. Veteran investors and analysts often see these downturns as necessary “resets” to cleanse the market of excesses accrued during overly speculative periods.

Looking Ahead

Though challenging, events like this are not uncommon in the high-stakes world of cryptocurrencies. They serve as a stark reminder of the risks involved in leveraged trading and the volatile nature of crypto markets. For the future, traders and investors might become more cautious, possibly reducing the overall leverage used in their crypto investments.

Moreover, the aftermath of this event could accelerate calls for more robust regulatory frameworks to govern crypto trading, aiming to strike a balance between protecting investors and encouraging innovation in the crypto space.

In conclusion, while the $740 million wipeout in Bitcoin might be seen as a setback, it could also be setting the stage for a more mature and stable market. As the dust settles, the next steps for investors, regulators, and market participants will be crucial in shaping the future trajectory of the cryptocurrency market.