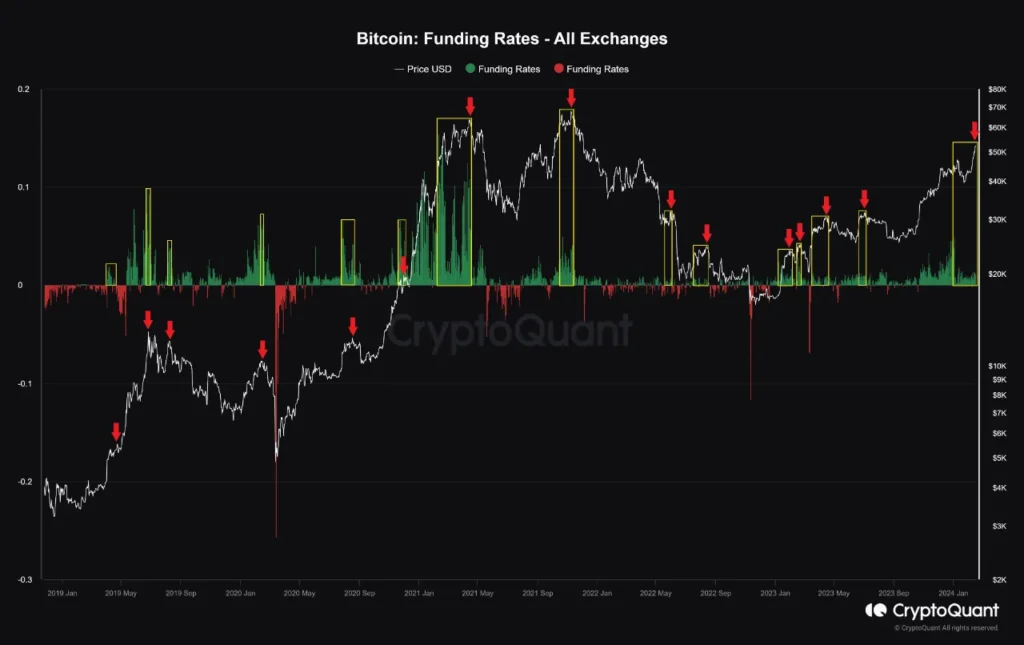

The present funding rate for both centralized exchanges (CEX) and decentralized exchanges (DEX) suggests a prevailing bearish sentiment in the market. This trend indicates that traders are largely anticipating a decline in asset prices. The funding rates, which reflect the cost of holding positions on these platforms, are critical indicators of market sentiment. A bearish funding rate typically signifies that more traders are shorting assets, expecting further price drops. Analysts often monitor these rates to gauge market psychology and potential future movements. As the funding rate remains bearish, it may influence trading strategies and investor decisions moving forward.

#post_seo_title #image_title