SOL Price Review: Whales Transfer Millions — Potential Rebound on the Horizon?

In recent weeks, the Solana (SOL) blockchain has witnessed significant activity among its most substantial holders, commonly known as ‘whales,’ who have been transferring millions of SOL tokens. This surge in whale transactions has caught the attention of investors and analysts, raising questions about the potential implications for the price of SOL, which has experienced volatility in the cryptocurrency market.

Analyzing the Movement: Whales in Action

The Solana network, known for its high-speed and low-cost transactions, is becoming a hotspot for large-scale transfers. Data from blockchain analytics firms suggest that several high-worth individuals and institutional players are shifting vast amounts of SOL, possibly reallocating their investments or positioning themselves for future price movements.

Transactions involving large sums can indicate various strategies. For example, whales could be moving their holdings to different wallets for security reasons, or they might be distributing their investments to manage risk better. Alternatively, such transfers might suggest that some whales are accumulating more SOL, potentially signaling their confidence in the network’s long-term prospects.

Market Impact and Speculation

Whale activities often lead to speculation about potential price impacts. In the past, we’ve seen that significant transactions can either uplift the market sentiment by demonstrating confidence or lead to price drops if the market perceives that these movements precede massive sell-offs.

Given the current dynamics where multiple large holders are making moves simultaneously, there is a mixed interpretation in the community. Some investors see this as a bullish signal, believing that whales are preparing for a future price increase. They argue that accumulating SOL at current levels could be a strategic decision ahead of anticipated positive developments in the Solana ecosystem, such as technological upgrades or increased adoption of its DeFi and NFT platforms.

Technical and Fundamental Factors

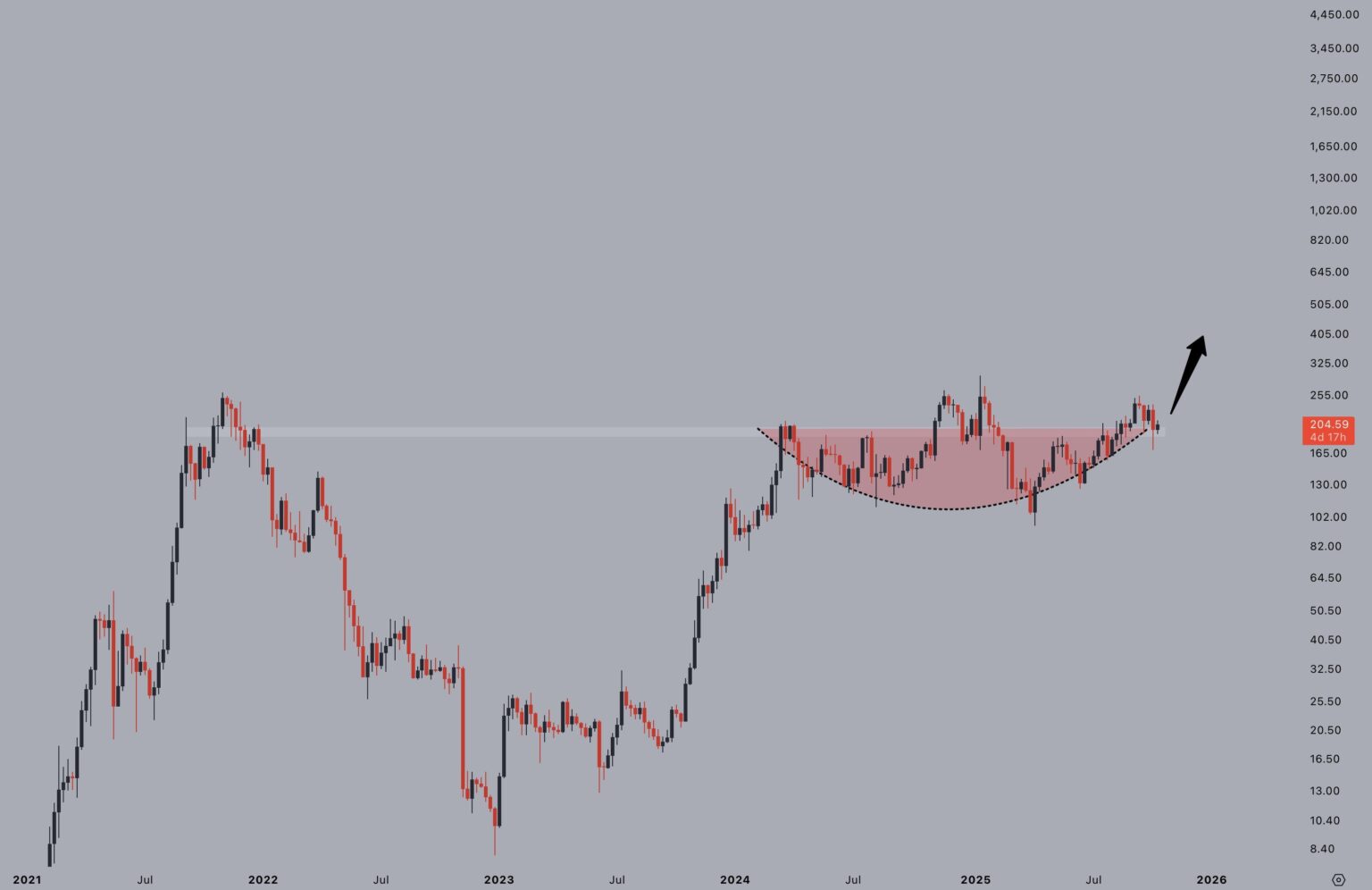

From a technical analysis standpoint, SOL has shown resilience by maintaining crucial support levels despite broader market pressures. Chart patterns and indicators such as Relative Strength Index (RSI) and Moving Averages could provide further insights into potential rebound zones where whales might be aiming to capitalize on price corrections.

Fundamentally, Solana continues to expand its ecosystem. Recent updates have focused on enhancing network stability and scalability – key factors that could attract more decentralized applications (dApps) and, consequently, more users and transactions. Partnerships, integrations, and community-building initiatives are also contributing positively to the Solana narrative in the crypto space.

Potential Rebound on the Horizon?

Whether or not the current whale activities foreshadow a significant rebound for SOL remains a subject of debate. While optimistic investors anticipate a recovery triggered by these movements, others advise caution, suggesting that the community should also consider external market factors such as regulatory news, global economic conditions, and the performance of the broader cryptocurrency market.

In conclusion, while the actions of Solana whales provide interesting points for speculation, it’s crucial for investors to keep an eye on both the macroeconomic landscape and the ongoing developments within the Solana ecosystem. Combining these insights with thorough technical analysis will be key in deciphering whether a potential rebound for SOL is indeed on the horizon. As with all investments, especially in the volatile crypto market, diversification and risk management should be top priorities.