XRP Sees 7,400% Spike in Purchases, But There’s a Twist

In an unexpected surge, XRP, the cryptocurrency native to the Ripple network, has seen a monumental 7,400% increase in purchase volume within a very short span. This spike is drawing the attention of both seasoned and novice investors across the globe. However, this sudden climb comes with a significant twist that potential investors should be aware of.

Understanding the Surge

The phenomenal rise in purchases can be primarily attributed to recent developments concerning Ripple’s ongoing legal battle with the U.S. Securities and Exchange Commission (SEC). Positive rumors regarding a potential settlement, alongside indications of a favorable outcome for Ripple, have fueled a whirlwind of speculative buying. Fans and investors of XRP are hopeful that a victory in court could potentially pave the way for renewed acceptance and integration of XRP in mainstream financial operations, further boosting its value.

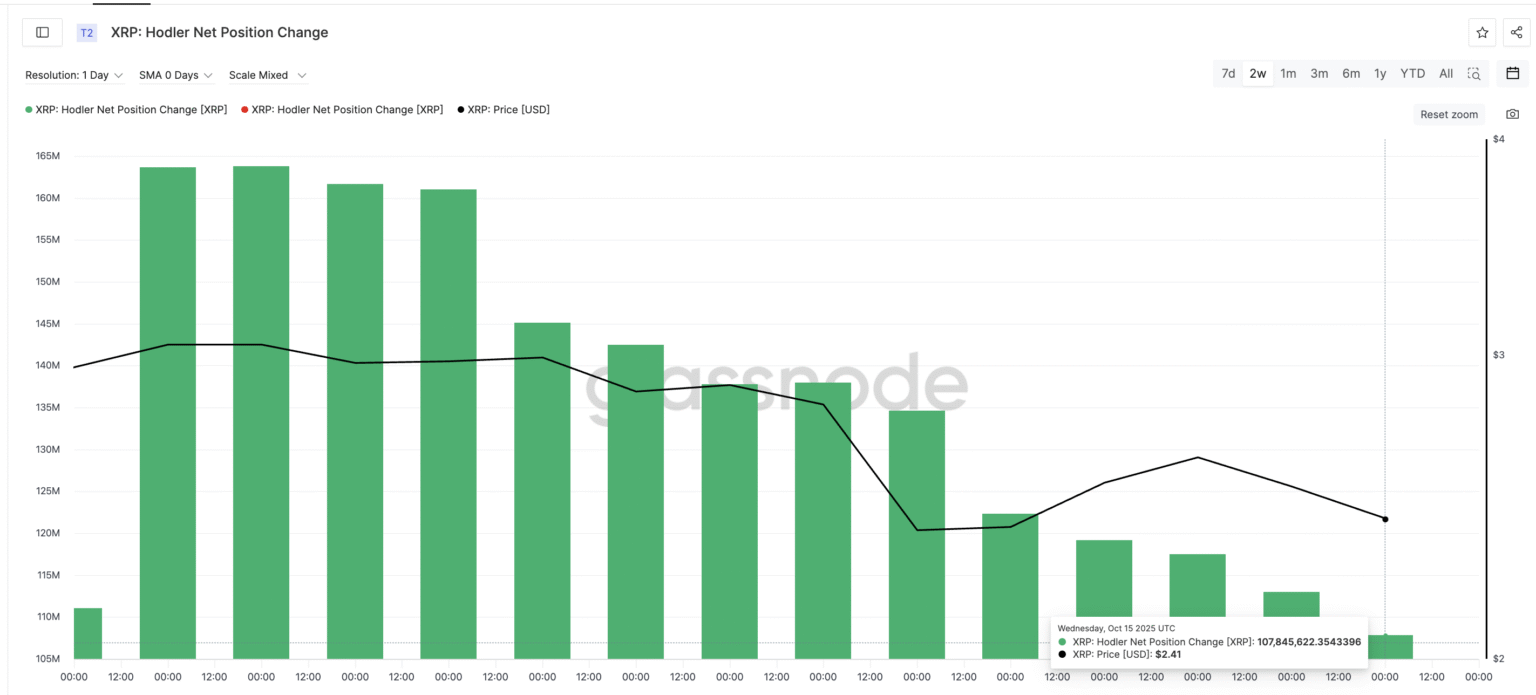

The Data Behind the Spike

Market analysis shows a massive influx of trading activity centered around XRP. The currency, which had been experiencing a stagnancy, suddenly saw daily trading volumes skyrocketing like never before. Social media platforms and crypto forums are awash with discussions and speculations regarding XRP, contributing even further to its trading frenzy.

The Twist: Buyer Beware

However, amidst this buying fervor lies a twist that raises a yellow flag—much of the increased buying activity of XRP is originating not from individual investors on usual cryptocurrency exchanges, but rather, from coordinated purchases. Groups of traders on platforms like Reddit and Telegram are orchestrating large-scale buy-ins to influence the price. This type of speculative group buying is reminiscent of the infamous GameStop stock incident and carries similar risks.

Pumping a digital currency in this manner can create temporary artificial price inflation. While this might offer a quick profit for some, it poses a significant risk of a sudden price crash once the coordinated buying slows down or if there’s a mass sell-off. The history of finance is riddled with crashes following such spikes, potentially leaving many holding a devalued currency if they don’t time their exit perfectly.

Market Reaction

The traditional investor community and financial analysts are watching this situation closely. While some argue that any attention to crypto helps the entire market, others worry about potential backlashes from market manipulation accusations, which could lead to tighter regulations or even legal actions.

Financial advisors are currently recommending caution. They suggest that any investment in XRP, particularly at this time, should be approached with a thorough understanding of the market dynamics and the legal situation surrounding Ripple. The risks involved with being influenced by coordinated buying schemes should be seriously considered.

Looking Forward

As Ripple continues to navigate its legal challenges, the future of XRP remains uncertain but intriguing. Should Ripple win its case against the SEC, XRP could potentially regress to its previous upward trajectory, supported by legitimate adoption and integration into financial systems rather than speculative buying.

In conclusion, while the 7,400% spike in XRP purchases is indeed historic, it’s enveloped in circumstances that warrant a cautious analysis. The outcome of Ripple’s legal battles, along with the stabilization of its market after this speculative bubble, will be critical to determining whether XRP can reclaim and exceed its former glory as a mainstream digital asset.