Cardano Whales Offload Holdings Despite Inflows Reaching a Three-Month Peak

In the dynamic world of cryptocurrencies, significant movements in token holdings by large-scale investors, colloquially known as ‘whales,’ often signal important shifts in market trends and investor sentiment. Recently, an intriguing situation has been unfolding with Cardano (ADA), as whale activities have diverged from the overall inflow trends observed in the marketplace. Despite ADA inflows reaching a three-month peak — potentially indicating growing investor interest — some prominent whales are offloading their holdings, prompting various speculations about the underlying reasons and future impacts.

Understanding the Surge in Inflows

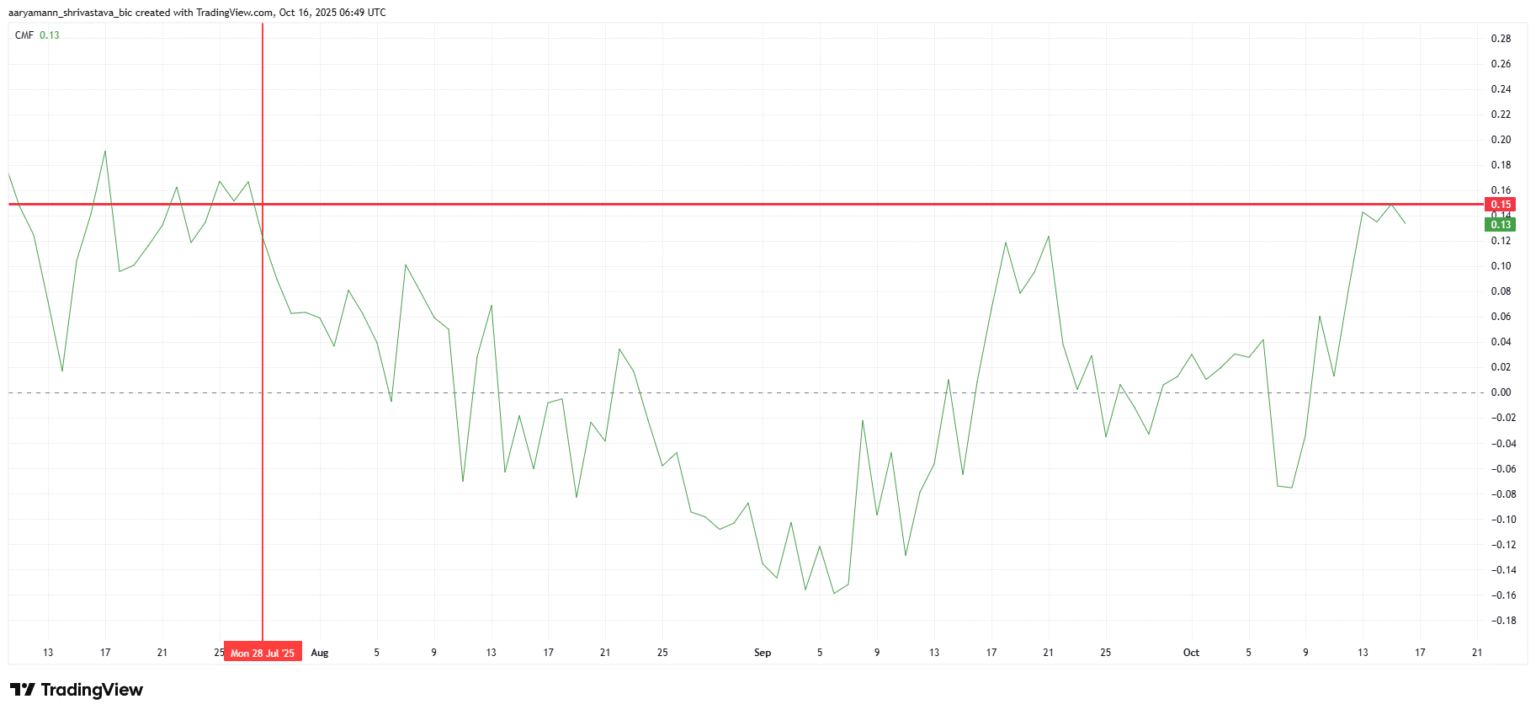

The three-month peak in Cardano inflows is notable because it suggests a renewal of interest among investors. Inflows typically represent transfers of large quantities of tokens into trading exchanges, often viewed as preparations for potential selling. Another perspective suggests that this could be a sign of investors gearing up to buy into ADA, anticipating future price increases. The precise interpretation of inflows can vary, but the heightened activity undeniably points to increased engagement with the Cardano token.

Whale Movements: Decoding the Sale

At the same time, several whales have started offloading parts of their holdings. This behavior can be counterintuitive in a period of increasing inflows and often leads to mixed signals in the market. The decision by whales to scale down their ADA investments could stem from several motivations:

-

Profit-Taking: Whales might be selling to capitalize on any recent price gains. Having accumulated tokens at lower prices, the selling could simply represent a strategic rotation out of ADA into other assets or cash.

-

Risk Management: Broad market uncertainties or specific developments within the Cardano network could have prompted whales to reduce their exposure. Diversification away from what might be seen as a consolidation or imminent price correction could be another factor.

- Portfolio Adjustment: As the broader crypto market evolves, whales may shift their holdings to optimize returns, including moving funds into newer or presently undervalued assets.

Implications for Cardano

The actions of whales carry weight due to their capacity to influence market dynamics significantly. A sell-off by whales can lead to a temporary bearish outlook for ADA, potentially triggering a price drop if smaller investors follow suit. However, it should be noted that whale actions are not the sole price determinant. Market fundamentals, broader economic conditions, and changes within the Cardano ecosystem itself play substantial roles.

If, for example, the increase in inflows is due to new or existing investors bolstering their ADA positions, this can counterbalance any negative price impact from whale sell-offs. Additionally, ongoing developments in the Cardano network, such as updates to its smart contract capabilities or enhancements improving scalability and security, could maintain or elevate investor interest independently of whale activities.

Forward Look

For potential investors and current holders of ADA, understanding the context and nuances of these movements — inflows and whale offloading — is essential. Monitoring not just the volume but also the nature of exchange inflows and the profiles of active whales can offer deeper insights into possible future trends.

Moreover, keeping an eye on broader market indicators and Cardano-specific news will be crucial. As always, a diversified investment approach and a clear understanding of individual risk tolerance should guide any investment decisions in the volatile crypto market.

In conclusion, although the recent activity of Cardano whales presents a complex picture, the increased inflows also suggest a vibrant, engaged investor base. Whether this will buffer Cardano’s market value against whale sell-offs or if it forecasts imminent price corrections remains to be seen. Keeping tuned into both macroeconomic factors and microeconomic data within the Cardano ecosystem will be key to navigating these turbulent waters.