COAI Price Surge May Reach New Heights; However, Consider These Potential Risks

In recent weeks, the share prices of COAI (Change Our AI Ltd.) have experienced an unprecedented surge, climbing to potential new heights as investors flock to inject capital into artificial intelligence technology. This fervor has been spurred by groundbreaking advancements in AI, promising a bright future for companies like COAI. Before diving into the buoyant wave that COAI rides, it is prudent for investors to consider both the exciting prospects and the underlying risks associated with this volatility.

The Catalysts Behind the Surge

COAI, a relatively obscure tech firm until recently, has caught the eye of technologists and investors due to its innovative approach to machine learning algorithms, which have wide applications, from healthcare diagnostics to autonomous vehicle technology. Furthermore, significant strategic partnerships with leading tech giants and promising earnings reports have bolstered confidence in COAI’s stock.

Moreover, the AI industry itself is currently enjoying heightened interest following several governments announcing significant funding and supportive policies aimed at boosting technological research and AI integration across various sectors. This macroeconomic tailwind has provided additional impetus for the stock’s stellar performance.

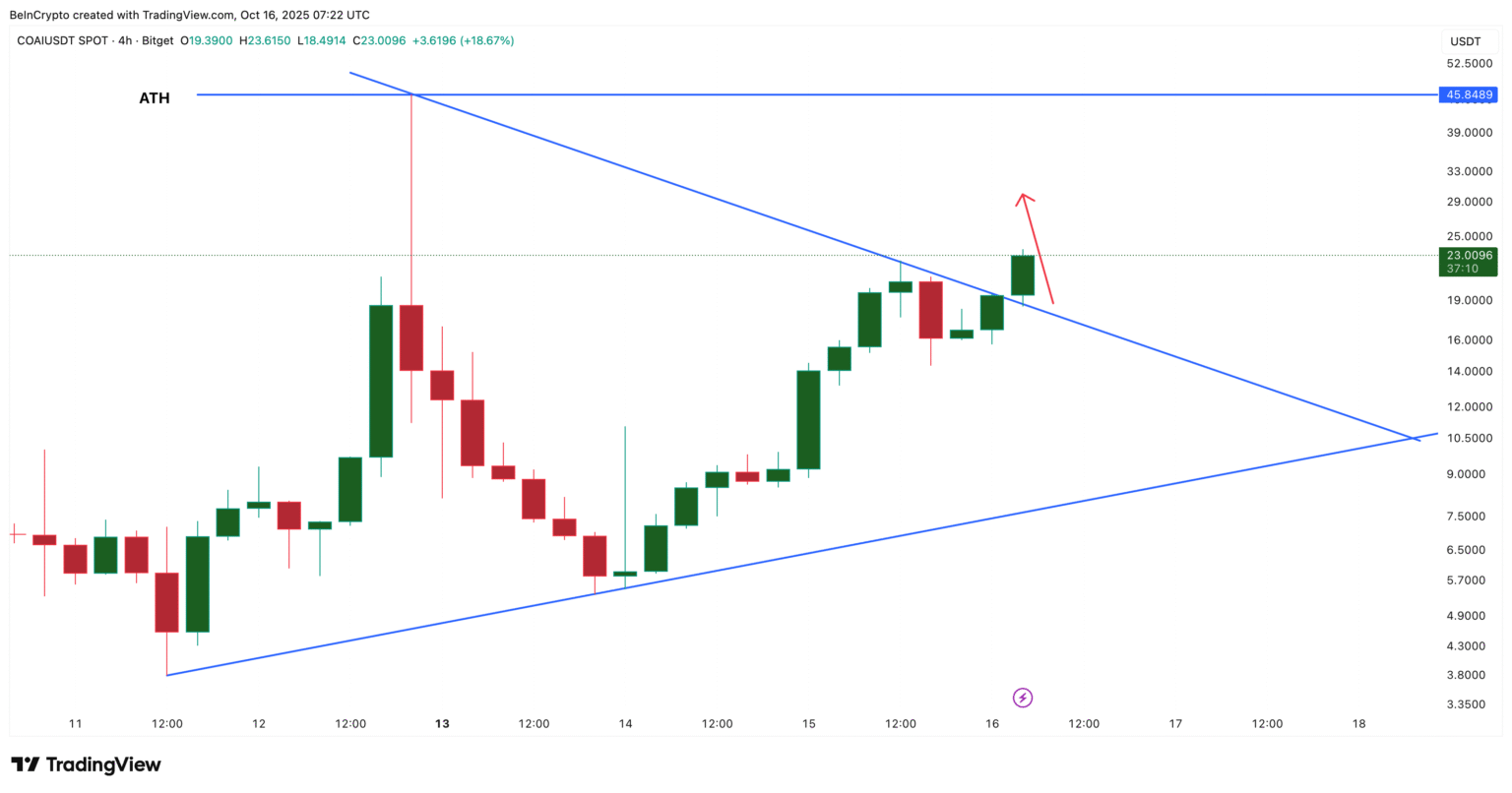

The Skyrocketing Trajectory

With the company’s recent favorable quarterly earnings and aggressive expansion plans, some market analysts project a potentially steep upward trajectory for COAI stocks in the following months. Trade volumes have spiked, and valuation metrics, though stretched by traditional standards, are being recalibrated in the context of futuristic growth expectations.

The Pitfalls and Risks

While the excitement around COAI’s prospects is palpable, this exhilaration must be tempered with caution due to several risks:

1. Volatility and Speculation

The technology sector, especially nascent industries like AI, is susceptible to high volatility and speculative trading. Stocks like COAI can experience rapid price swings based on news cycles, investor sentiment, or market rumors, which might not always align with the company’s fundamental value.

2. Regulatory Challenges

As AI technology permeates more facets of everyday life, governments may step in to impose stringent regulations concerning data privacy, usage, and ethical considerations. Such regulations could stifle innovation or redirect resources, potentially affecting COAI’s operational freedom and profitability.

3. Technological Obsolescence

In the fast-evolving AI landscape, today’s innovation can quickly become tomorrow’s history. COAI faces fierce competition from both established tech behemoths and nimble startups. Continuous innovation and adaptation are critical, but they also pose a significant financial drain with uncertain returns.

4. Overdependence on AI

COAI’s core business is heavily reliant on the broader adoption and integration of AI technologies. Any slowdown in the AI sector, whether due to economic downturns, technological failures, or societal pushback against AI solutions, could disproportionately affect the company.

5. Intellectual Property Issues

In the tech world, the theft or infringement of intellectual property can lead to costly legal battles or loss of competitive advantage. Protecting innovations while fostering collaborative industry growth can be a delicate balance for COAI to manage.

Conclusion

While the future for COAI and the AI industry appears incredibly promising, with forecasts pointing towards continued growth and integration into various sectors, investors should approach with a balanced perspective. By understanding both the drivers of growth and the inherent risks, investors can better position themselves to make informed decisions. Diversification of investment, constant vigilance on industry trends, and a cautious optimism could be wise strategies in navigating the volatile but potentially rewarding AI market landscape.