Long-Term Holder Behaviors May Hinder Ethereum’s Journey to $5,000

Ethereum, the blockchain platform known for its pioneering role in facilitating smart contracts and decentralized applications, has been on a rollercoaster ride in the cryptocurrency market. With aspirations to hit a landmark price of $5,000 per Ether, the digital currency faces multiple roadblocks, not least of which are the behaviors of Long-Term Holders (LTHs). These individuals, who hold onto their investments through highs and lows, may be unintentionally hampering Ethereum’s potential growth trajectory.

Understanding LTH Impact

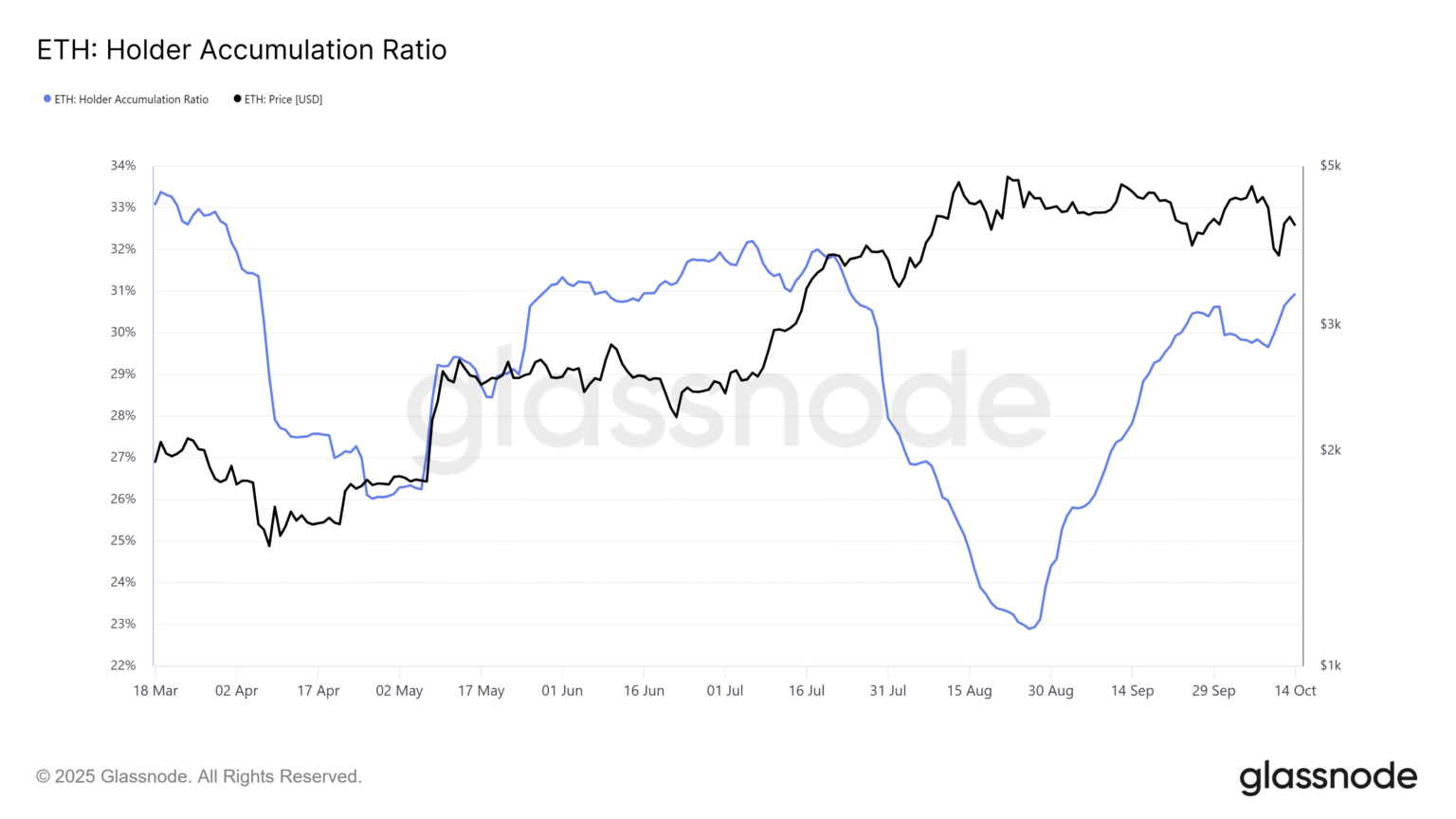

Long-Term Holders are typically celebrated for stabilizing the market. Their unwillingness to sell their holdings during downturns helps prevent large, panic-driven price drops. However, this same behavior creates a double-edged sword in terms of price dynamics. When prices rise, the reluctance of LTHs to sell can constrain the available supply, restricting the usual influx of coins onto the market that would occur as prices increase and making it difficult for new investors to buy in without significantly driving up prices.

Supply Scarcity and Market Liquidity

One immediate consequence of LTH behavior is the creation of a scarcity in readily available Ethereum tokens. This supply squeeze can lead to increased price volatility—a factor that could deter more risk-averse investors and institutions from entering the market. For Ethereum to reach the $5,000 milestone, it requires not just speculative interest but substantial, sustained investment from a broader investor base, including institutional entities looking for stability and consistency.

Price Inertia Due to Static Supply

Another repercussion of reduced supply turnover is price inertia. Cryptocurrencies like Ethereum experience price appreciation when there’s a healthy balance of buying and selling. However, if LTHs refuse to sell even as prices rise, this can lead to a stagnation where the price ceases to climb simply because the typical market dynamics are disrupted. This is particularly problematic for Ethereum, aiming for a high target like $5,000; the asset needs every bit of market dynamics it can get to help push up its valuation.

Psychological Factors

The psychological impact of LTH behavior should not be underestimated. New investors may feel uneasy about entering a market dominated by long-term holders who might, at any point, decide to cash out their substantial holdings, potentially crashing the market. This fear can prevent fresh capital from flowing into Ethereum, thus slowing down its journey to the much-anticipated $5,000 mark.

The Counter-Argument: The Positives of LTH Stability

It’s essential, however, to consider the benefits that LTHs bring to the Ethereum market. Their commitment to holding their assets for extended periods contributes to the overall market stability, reducing the likelihood of extreme volatility seen in less mature markets. This stability can be a positive signal to new institutional investors who prefer entering markets that are not prone to drastic fluctuations.

The Road Ahead

To accommodate both the interests of LTHs and the needs of new investors, Ethereum might benefit from encouraging strategies that ensure more circulation of the currency while maintaining the core group of LTHs. These strategies could include promoting staking, offering long-term holder benefits that do not involve selling the assets, or creating more use cases for Ethereum to increase transaction volume and market participation.

Ultimately, Ethereum’s path to $5,000 will depend on finding an equilibrium that respects the foundational role of LTHs while fostering a dynamic, inclusive environment that attracts diverse investor groups. The journey is as much about community and strategy as it is about market economics, and Ethereum must navigate this landscape cleverly to reach its ambitious financial targets.