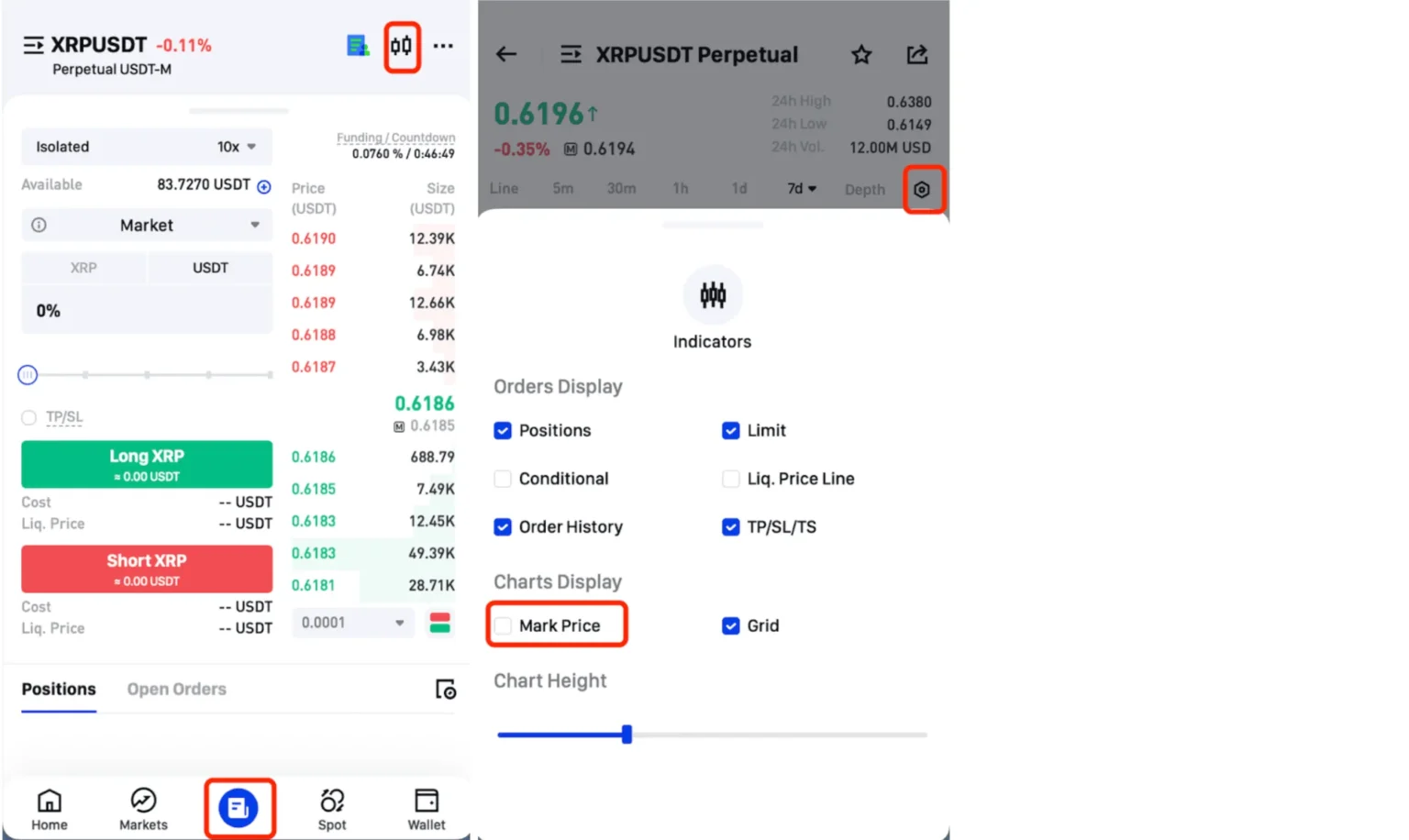

Binance has announced the adoption of Mark Price Liquidation for its futures trading to address the impact of price manipulations on its platform. This new measure aims to mitigate issues arising from singular platform price manipulation, which can distort market conditions. By implementing this strategy, Binance intends to create a more stable trading environment for its users. Mark Price Liquidation is designed to protect traders from sudden price fluctuations that may not accurately reflect the broader market. This initiative reflects Binance’s commitment to maintaining integrity and reliability in its trading operations.

#post_seo_title #image_title

Binance Futures Implements Mark Price Liquidation to Combat Manipulat

Related Posts

Add A Comment