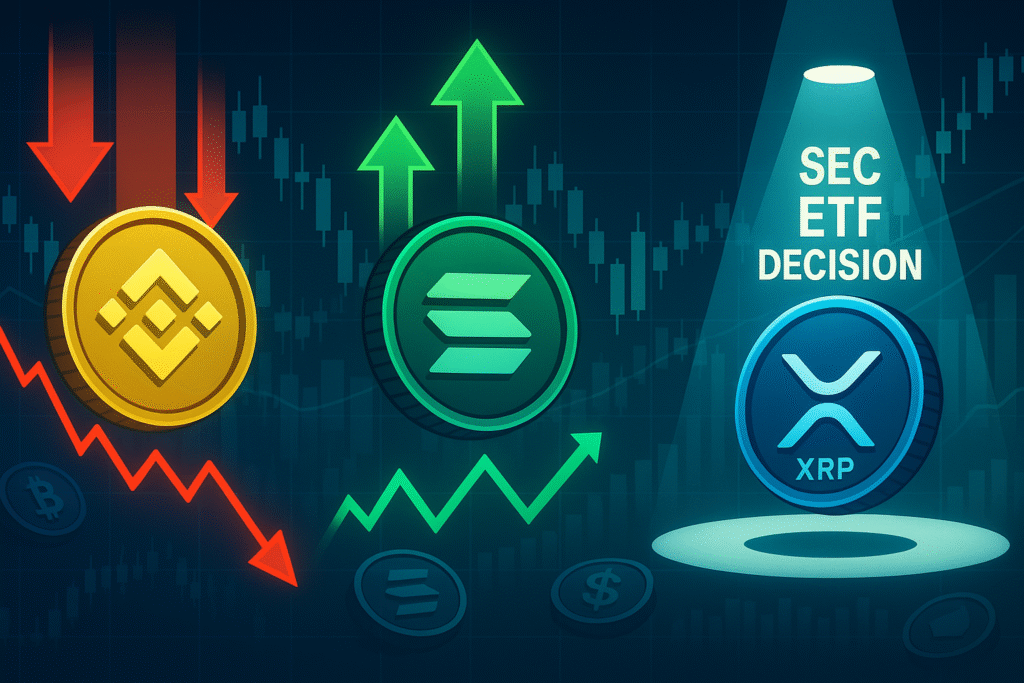

Crypto Roundup: BNB Declines by 10% While SOL Nears $200; Latest on XRP ETFs

In a turbulent week for cryptocurrencies, Binance Coin (BNB) saw a significant decline, dropping about 10%, while Solana (SOL) demonstrated resilience, nearing the $200 mark. Meanwhile, there’s growing interest in the development of Exchange Traded Funds (ETFs) based on Ripple’s XRP, despite the ongoing regulatory scrutiny the asset faces.

Binance Coin Faces Setbacks

BNB, the native cryptocurrency of Binance, the world’s largest cryptocurrency exchange by trading volume, has experienced a noticeable downturn. Over the past week, BNB’s value has decreased by approximately 10%. Analysts attribute this downward trend to multiple factors including broader market corrections, regulatory concerns in several countries regarding Binance’s operations, and possible internal adjustments as Binance continues to expand and restructure its business model.

Despite the recent dip, BNB remains a significant player in the cryptocurrency environment. Binance continues to push innovations and expansions that could see the coin bounce back shortly. Traders and investors are closely watching how Binance manages regulatory hurdles and adapts to the increasingly scrutinized crypto landscape.

Solana’s Bullish Trajectory

Contrasting with BNB, Solana (SOL) has been on a bullish trajectory, edging closer to the 0 mark—a price point not seen since its peak in 2021. This surge is driven by its growing ecosystem and the broader adoption of its technology in decentralized finance (DeFi) and non-fungible tokens (NFTs). Solana is praised for its high throughput and lower transaction costs, which make it a preferred platform among developers and users alike.

The momentum behind Solana also comes from multiple strategic partnerships and integrations across various sectors, including gaming and social media, wherein blockchain capabilities are leveraged to enhance user experiences.

Developments in XRP and the ETF Landscape

The crypto community is closely monitoring the developments around XRP, particularly with the anticipation around potential XRP-based ETFs. Despite Ripple facing a lawsuit from the U.S. Securities and Exchange Commission (SEC), the interest in XRP has not waned. Financial product issuers are exploring the introduction of ETFs that track XRP, which could provide a more mainstream vehicle for investors to gain exposure to XRP without owning the underlying assets directly.

An XRP ETF would not only signify a milestone for Ripple but also potentially influence the SEC’s ongoing case with Ripple. A favorable outcome for Ripple and the approval of XRP ETFs could lead to increased institutional adoption and bolster the legitimacy of XRP as a digital asset.

Market Outlook

The cryptocurrency market continues to be highly volatile, with substantial price movements that often occur in brief periods. As the industry navigates through regulatory frameworks, technical advancements, and macroeconomic factors, participants remain cautiously optimistic.

Investors are advised to remain vigilant, conduct thorough research, and consider diversification to manage risks effectively in this dynamic market environment. As cryptocurrencies increasingly intersect with traditional financial markets, the evolution of products like ETFs is expected to bridge the gap between conventional investments and digital assets, potentially ushering in a new era of integration for the sector.