Bitcoin Stumbles Once More, Prompting a $200 Billion Market Erasure: Can BTC Recover?

In the ever-turbulent world of cryptocurrency, Bitcoin has once again found itself at the center of a dramatic downturn, erasing approximately $200 billion in market value. This recent drop raises concerns and questions about the resilience and stability of the leading cryptocurrency.

The Latest Plunge

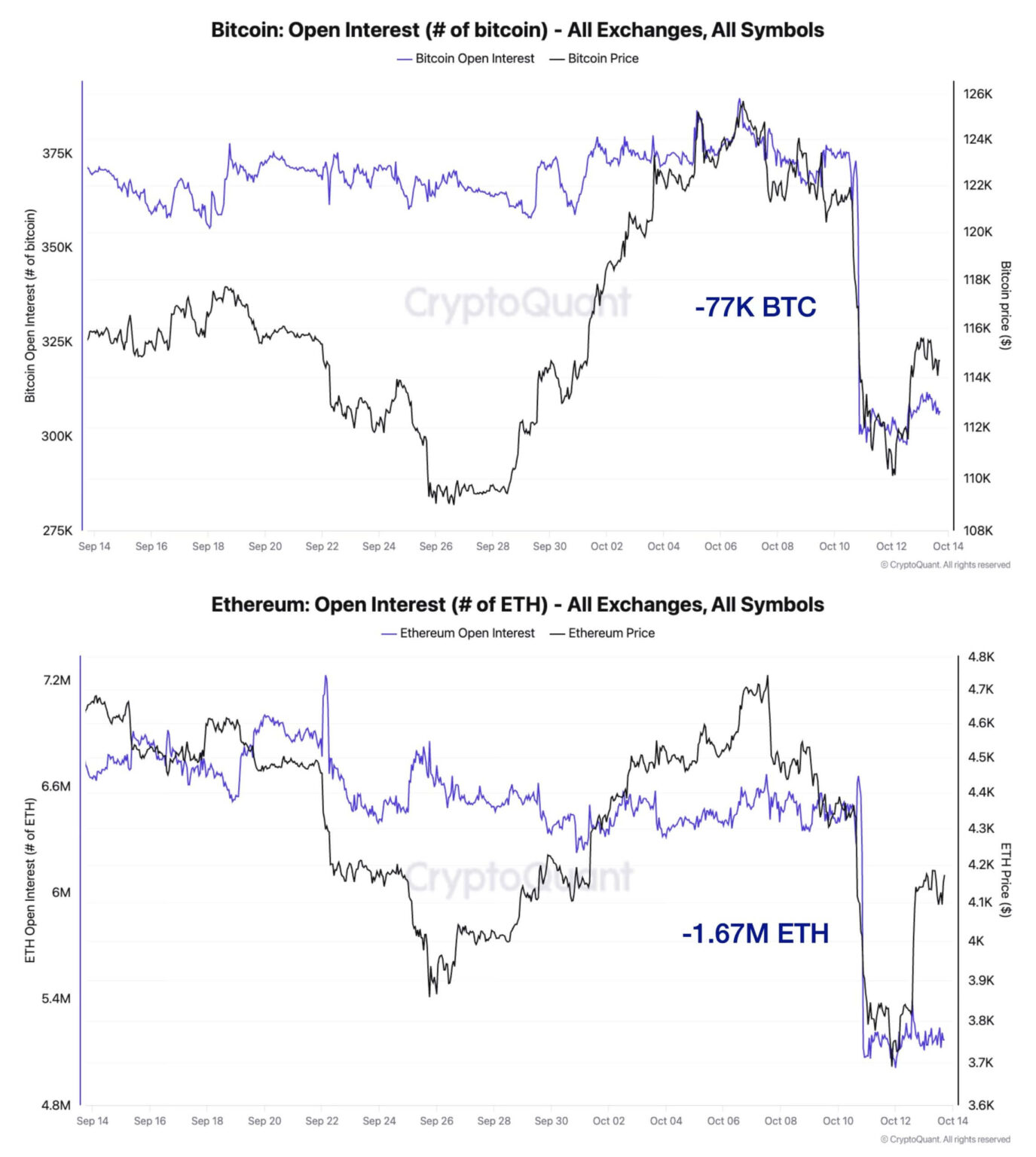

Recently, Bitcoin investors witnessed another sharp decline as the cryptocurrency dipped by over 15% in a matter of days. This downturn is part of a broader trend in the crypto market, which saw similar declines across other major cryptocurrencies like Ethereum, Binance Coin, and Solana. Analysts point to a combination of factors for this market behavior, including regulatory pressures, macroeconomic influences, and changing investor sentiments toward riskier assets.

Influencing Factors

-

Regulatory Scrutiny: Increasing scrutiny by governments around the world has put additional pressure on Bitcoin and other cryptocurrencies. Countries like China have outright banned cryptocurrency transactions, while others are considering stringent regulations to curb speculative trading and enhance investor protection.

-

Macroeconomic Conditions: The current global economic climate, characterized by rising inflation and potential interest rate hikes by central banks (notably the U.S. Federal Reserve), has made investors cautious. Cryptocurrencies, often viewed as riskier investments, tend to see reduced demand in such uncertain times.

- Market Sentiments: The mood in the investment landscape has shifted notably with investors becoming wary of putting their money into assets perceived as volatile amid the current global economic slowdown. This shift is noticeably impacting the demand for Bitcoin.

The Path to Recovery

Despite the grim scenario, not all hope is lost for Bitcoin. Cryptocurrency, by design, tends to be highly volatile, and recoveries can be just as swift as declines. Several factors could potentially drive a Bitcoin comeback:

-

Adoption and Integration: More businesses and financial institutions are integrating Bitcoin and other cryptocurrencies into their payment systems and services. Increased adoption could normalize cryptocurrency use, enhancing its value proposition.

-

Technological Advancements: Innovations within the blockchain space, such as improvements in scalability and security, could make Bitcoin more attractive to both consumers and investors.

- Asset Diversification: In times of geopolitical tensions or economic uncertainty, Bitcoin has occasionally been referred to as “digital gold,” with some investors using it as a hedge against inflation. This perspective might regain popularity as people look to diversify their investment portfolios.

Looking Ahead

The road ahead for Bitcoin remains uncertain. With potential hurdles like increased regulation and variable economic conditions, the cryptocurrency needs to navigate a complex landscape. However, Bitcoin has shown remarkable resilience in its relatively short history, bouncing back from severe downtrends to reach new peaks.

Investor sentiment will play a critical role in Bitcoin’s recovery, influenced by regulatory developments, technological enhancements, and broader economic factors. As the market continues to mature, it may also begin to exhibit more stability, which could attract a new wave of investors looking for alternative investment opportunities.

In conclusion, while Bitcoin faces undeniable challenges, its ability to withstand and recover from adversities suggests a future with potential for both growth and innovation. Conversely, only time will tell if this digital currency can truly cement itself as a staple in investment portfolios across the globe.