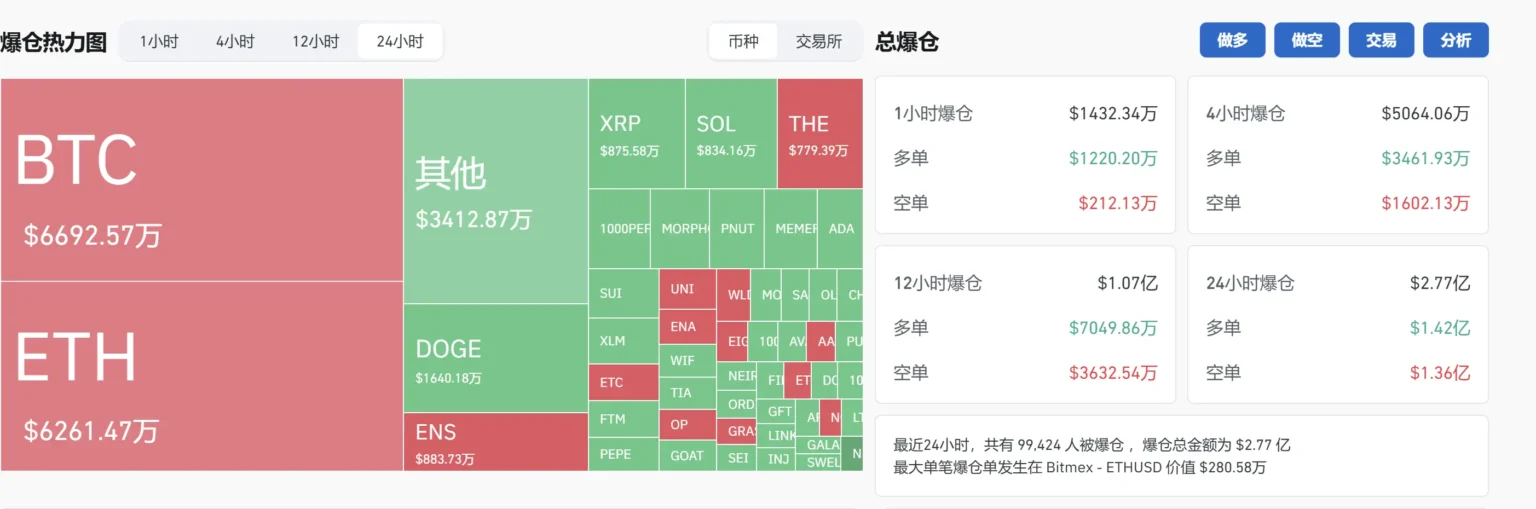

In the past hour, the network has experienced $142 million in total liquidations, primarily driven by long positions. Liquidations indicate that traders are forced to close their positions, often at a loss, due to unfavorable market conditions. Long positions, where traders bet on price increases, have contributed the most to this significant figure. This substantial amount highlights the volatility in the market and the risks associated with such trading strategies. Liquidation events like this can dramatically impact market sentiment and lead to further price fluctuations. Traders are advised to be cautious and manage their risk exposure in light of these developments.