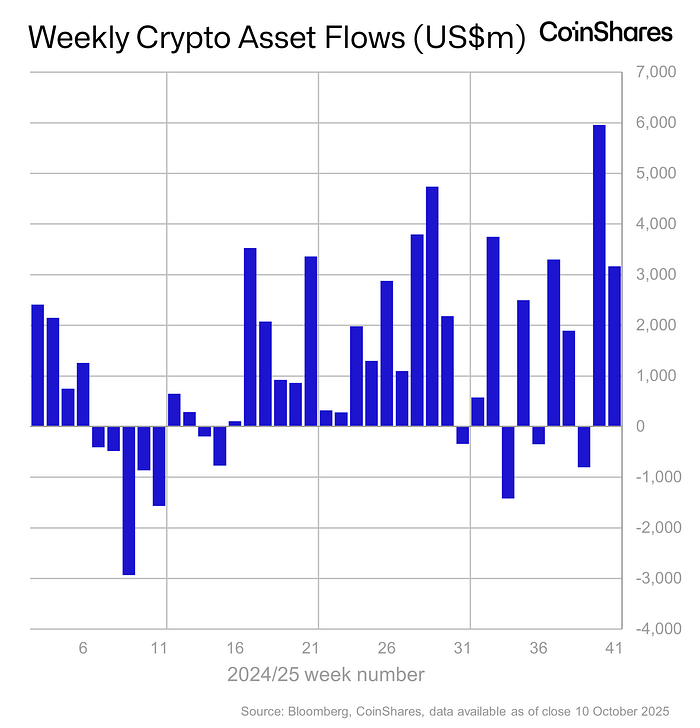

CoinShares Report Reveals $3 Billion in Crypto Inflows Last Week

In a significant turn of events in the cryptocurrency market, the latest report from CoinShares, a leading digital asset investment firm, has highlighted a massive influx of investments totaling $3 billion in the last week alone. This surge in capital inflow marks one of the most pronounced weekly increases in recent history, signaling a growing investor confidence and a potential shift in market dynamics.

Analyzing the Surge in Inflows

The $3 billion inflow into cryptocurrencies comes at a time when the global financial markets are facing considerable uncertainty, driven by varying economic policies, inflation concerns, and geopolitical tensions. Investors are increasingly turning to digital assets as a hedge against traditional financial market volatility and as a means to diversify their investment portfolios.

Distribution Across Digital Assets

The CoinShares report breaks down these inflows by cryptocurrency, offering a clear view of investor preferences. Bitcoin, being the largest by market capitalization, has predictably attracted the majority of the investment, representing a significant portion of the inflow. However, substantial amounts were also allocated to other major cryptocurrencies such as Ethereum, Binance Coin, and several altcoins, which have seen growing interest due to their unique utilities and burgeoning technologies.

The Role of Institutional Investors

One standout aspect of the recent influx is the notable participation of institutional investors. Traditionally cautious, these large scale participants seem to have shed some of their reservations about digital assets, possibly swayed by the maturing regulatory landscape and the advanced infrastructure being built around the market. The active engagement of these institutions is not only a testament to the growing legitimacy of cryptocurrencies but also a crucial factor in the scale of inflows observed.

Geographic Trends

The report also sheds light on geographical trends in cryptocurrency investments. North America and Europe continue to dominate the landscape, but increasing contributions are coming from Asia and the Middle East. This geographical diversification indicates a global shift towards the acceptance and integration of digital assets within traditional financial systems.

Implications for the Market

This unprecedented wave of investments could have several implications for the cryptocurrency market. Firstly, the infusion of such significant capital could lead to an increase in market stability, which might help alleviate some of the notorious volatility associated with cryptocurrencies. Secondly, the participation of institutional investors is likely to spur better governance and regulatory clarity, which, in turn, could attract more investors.

Furthermore, the allocation patterns seen in the inflow of funds might direct future developments and innovations within the space. Cryptocurrencies receiving greater investments will likely see accelerated development in their ecosystems, possibly driving their utility and adoption further.

Concluding Thoughts

The report from CoinShares offering insights into the $3 billion inflow into cryptocurrencies last week is a robust indicator of the dynamic and evolving nature of the digital asset market. While it brings to light the growing confidence among investors, it also casts a spotlight on the necessary advancements in regulatory and infrastructural frameworks needed to sustain such growth. As the cryptocurrency market continues to mature, it remains to be seen how the interplay of investments and innovations will shape the future of this promising financial frontier.