Bitcoin Price Approaches $115,000 as Investors Hold Onto Their Shares

As the world gradually embraces digital assets, Bitcoin continues to take center stage, exemplifying the robustness of cryptocurrency investments. Recently, Bitcoin’s price has soared, approaching an unprecedented $115,000. This surge is primarily attributed to a shift in investor behavior, with a growing number tending to hold onto their shares rather than capitalizing on short-term price swings.

Unprecedented Rally

Bitcoin has undergone numerous cycles of volatile growth and corrections. However, the current price hike is notable not just for its magnitude but for the underlying confidence it reflects among seasoned investors and newcomers alike. Analysts observe that this bull run is fueled by several key factors, including institutional adoption, fears of inflation, and the increasing acceptance of Bitcoin as a ‘digital gold’.

The cryptocurrency’s journey towards the $115,000 mark has been bolstered by significant investments from large corporations and endorsements from high-profile financial figures. Such endorsements have not only added legitimacy to Bitcoin but have also sparked a widespread reassessment of its potential as a long-term investment asset.

Holding Over Trading

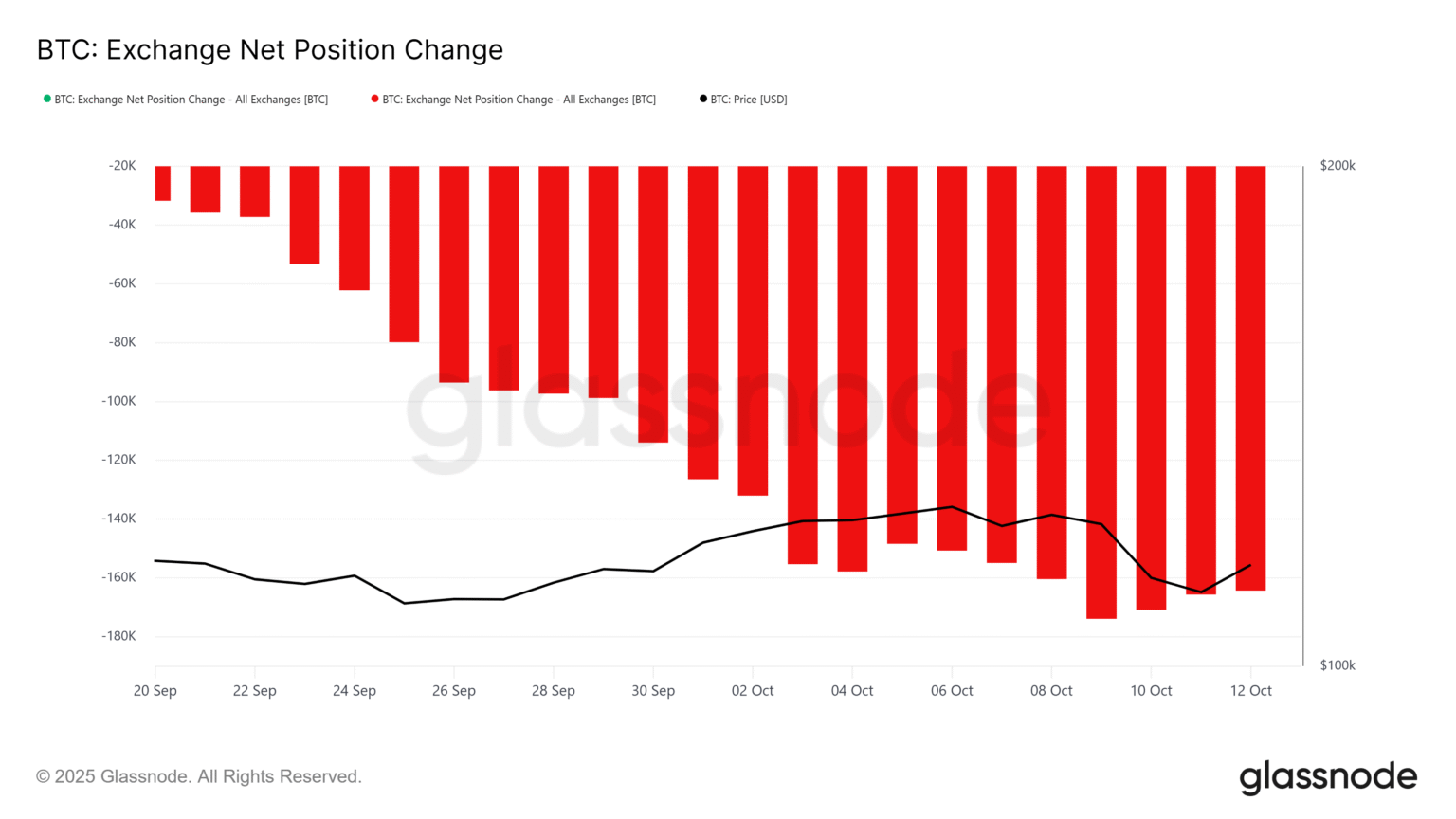

Unlike previous rallies where Bitcoin holders would quickly sell their holdings to realize gains, the current market shows a trend where the majority of Bitcoin is being held for extended periods. This behavior indicates a shift in the investor’s perspective, viewing Bitcoin as a valuable store of value, akin to gold. Data from blockchain analytics firms reveal that the amount of Bitcoin held in long-term storage is at an all-time high, signifying entrenched confidence in its value retention capabilities.

Furthermore, the reduced velocity of Bitcoin transactions suggests that fewer coins are being moved between wallets and sold on exchanges, contributing to the scarcity that drives the price upwards. This scarcity, combined with increased demand, sets the stage for unprecedented price levels.

Regulatory and Macro-Economic Landscape

The ascent of Bitcoin also comes amidst a rapidly changing regulatory landscape. Governments and financial regulators across the globe are working to establish frameworks to integrate cryptocurrencies within their national economies safely and effectively. While regulatory news has historically caused price volatility, recent developments have largely been perceived as positive, providing clearer guidelines that enhance stability in the crypto markets.

Moreover, the macroeconomic environment characterized by low-interest rates and high liquidity injections from central banks has compelled investors to look for alternative high-return investments. In this context, Bitcoin has emerged as a compelling choice due to its decentralized nature and its finite supply, making it resistant to inflationary pressures.

Future Outlook

Looking ahead, the sentiment around Bitcoin remains overwhelmingly positive. As traditional financial institutions continue to integrate cryptocurrency offerings and technological advancements make Bitcoin more accessible, its price could continue to climb. However, potential investors should remain conscious of the complex dynamics and inherent volatility within the cryptocurrency market.

In conclusion, Bitcoin’s approach toward the $115,000 mark is a testament to its growing acceptance and confidence among a broad array of investors. While this presents exciting opportunities, it underscores the need for educated investment decisions in the evolving landscape of digital currencies. As always, the future of Bitcoin remains a compelling narrative to watch, full of potential and unpredictability.