Synthetix (SNX) Reaches 10-Month Peak — Can the Surge Continue?

In the dynamic realm of cryptocurrency, the ascent of Synthetix (SNX) seizing a 10-month peak has ignited a buzz within the crypto community and prospective investors. Synthetix, originally known as Havven, is a decentralized finance (DeFi) platform renowned for enabling the creation of synthetic assets linked to the value of real-world assets such as currencies, commodities, stocks, and indices. Let’s delve into the factors propelling this surge, the current state of the platform, and explore whether SNX can sustain its upward trajectory.

What Sparked the Surge?

The recent upswing in SNX’s market value can be attributed to various substantial factors:

- DeFi Sector Growth: As global interest in DeFi escalates, platforms like Synthetix, which offer crucial infrastructure, benefit significantly. Synthetix allows users to mint, trade, and manage synthetic assets (synths), which are pivotal in the decentralized trading sector.

- Protocol Upgrades and Innovations: The Synthetix community has recently approved and implemented several enhancements and additional features, improving transaction speeds and reducing fees. Innovations such as atomic swaps and integration with other protocols have also elevated its market stance.

- Strategic Partnerships and Expansions: Partnerships with other blockchain entities and expansion into new markets, like the incorporation of layer 2 solutions like Optimism, have had a pronounced effect on Synthetix’s market valuation.

- Bullish Crypto Market Trends: The general uptrend in the crypto market, facilitated by increased institutional adoption, has also played a role in enhancing investor confidence in projects like Synthetix.

Analysis of the Current Market Position

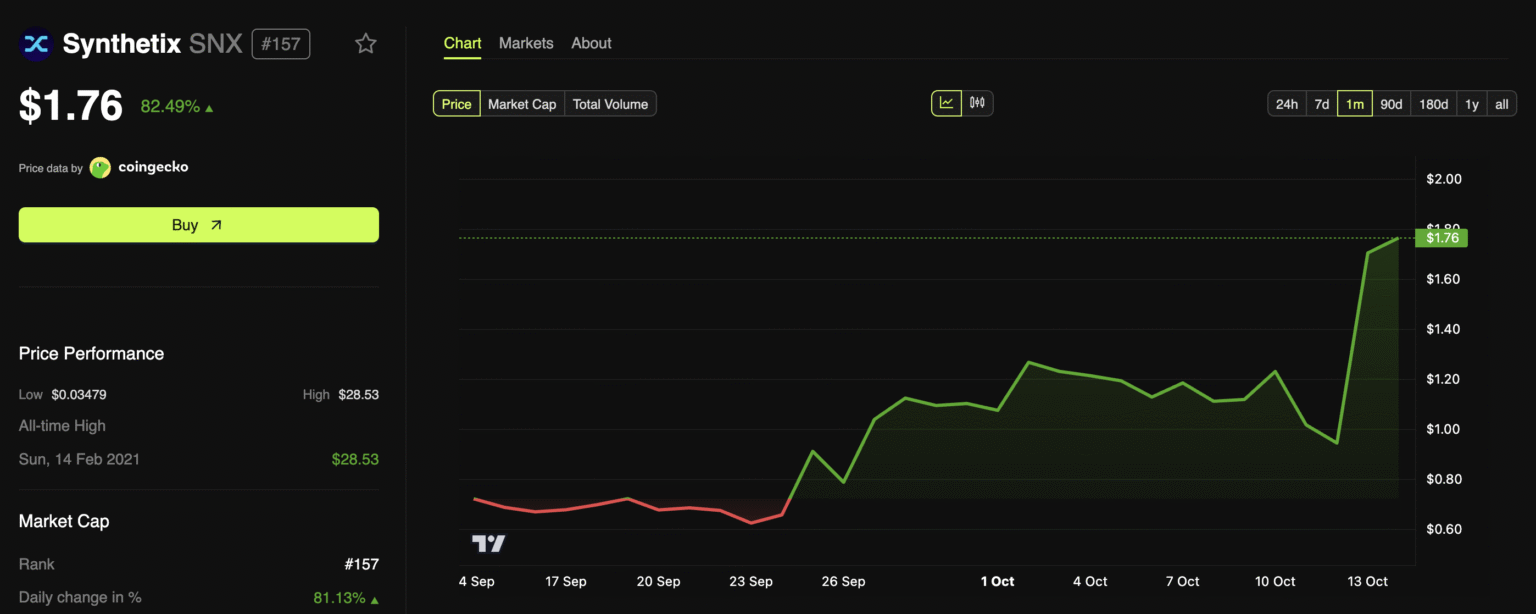

At a 10-month high, SNX appears to be in a robust position. The trading volume has escalated, and market capitalization has expanded, placing Synthetix as a notable player in the DeFi space. However, it is crucial to scrutinize the sustainability of this peak.

One must consider the overall health of the crypto market, the ongoing developments within the Synthetix ecosystem, and the general trend towards greater utilization of decentralized financial services. Positive improvements in these areas could indeed push SNX to new heights.

Possible Challenges Ahead

While the forecast looks promising, several challenges could impede SNX’s growth:

- Market Volatility: The crypto market is notoriously volatile. Unexpected downturns can rapidly affect high-flying assets like SNX.

- Regulatory Hurdles: Increasing scrutiny from regulatory bodies can pose significant hurdles, especially in a field as intricate as synthetic assets.

- Technical Setbacks: Any glitches or failures in updating the platform might slow down transaction times or compromise security, thereby shaking investor confidence.

Future Prospects: Is the Surge Sustainable?

Optimism seems to be a reasonable stance considering the recent developments and Synthetix’s proactive approach to adaptation and improvement. If the platform continues to evolve and expand, tailoring its services to meet the growing demands of the DeFi sector and maintaining its innovative edge, the surge can certainly have legs. Moreover, as long as the wider crypto market continues its upward trend and the DeFi space stays robust, SNX might not only sustain its current peak but also scale new heights.

Conclusion

Synthetix’s rise to a 10-month high is a testament to its resilience and capacity to innovate in the fast-paced DeFi sector. Whether this uptrend can be maintained will depend on multiple factors, including market conditions, technological advancements, and regulatory environments. For enthusiasts and potential investors, keeping a close eye on these factors will be key to understanding and predicting the future trajectory of SNX. As with any investment, however, caution and thorough research remain paramount to navigating the unpredictable waters of cryptocurrency investments.