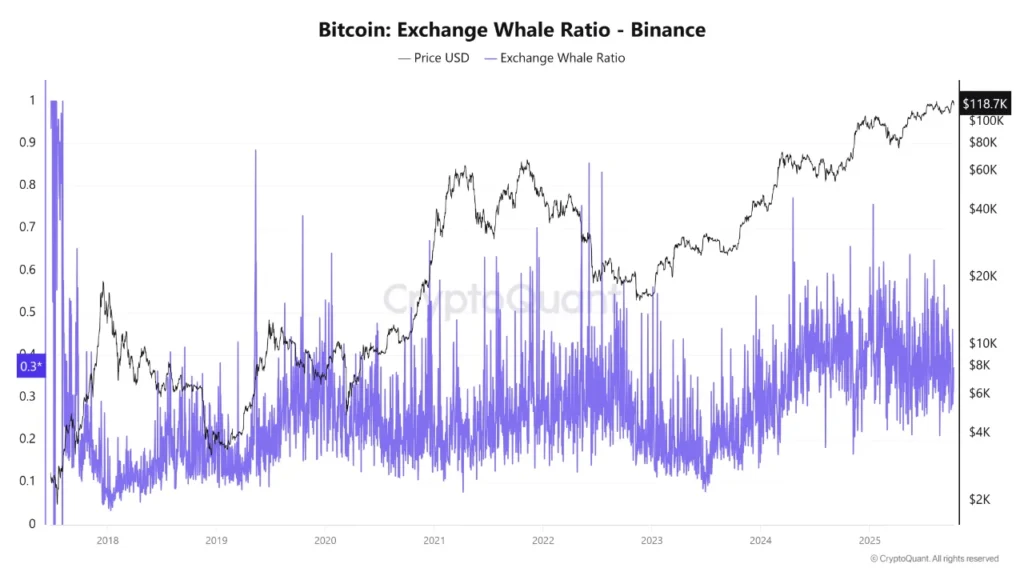

Recent analysis indicates that the notable decline in the market should not be interpreted as the onset of a bear market. Instead, it appears that significant market players, often referred to as “whales,” are maintaining their positions and actively engaging in purchasing during this dip. This behavior suggests a level of confidence among these major investors, as they continue to hold their assets rather than panic sell. The decision to “buy the dip” reflects a strategic approach to market fluctuations, indicating that these investors see potential value in the current pricing.

The market’s dynamics can often lead to fear and uncertainty among smaller investors, but the actions of these whales serve as a counterbalance. Their willingness to invest during downward trends can signal to others that there may be opportunities for recovery ahead. This perspective is crucial for understanding market psychology and the potential for future growth, even in the face of immediate declines.

In summary, while a sharp decline can cause alarm, it is essential to consider the behaviors of influential market participants. Their continued investment during these times can provide insights into the overall market sentiment and potential recovery trajectories.