HBAR Price Targets Rebound to Specific Level as Selling Pressure Decreases

As the cryptocurrency market continues to mature and expand, individual crypto tokens like Hedera Hashgraph’s HBAR are drawing increasing attention, not just for their technology but also for their investment potentials. Recently, HBAR has seen a notable increase in its price, driven by a decrease in selling pressure and growing enthusiasm about its underlying technology and strategic partnerships.

Understanding the Rally

Hedera Hashgraph, distinct from typical blockchain technology, employs a directed acyclic graph (DAG) that enables higher scalability and speed, which promises improvements over conventional blockchain systems. After experiencing a dip in its price due to broad market corrections and high selling pressures, HBAR is showing signs of a strong rebound.

Investors and analysts attribute this rebound to several key factors:

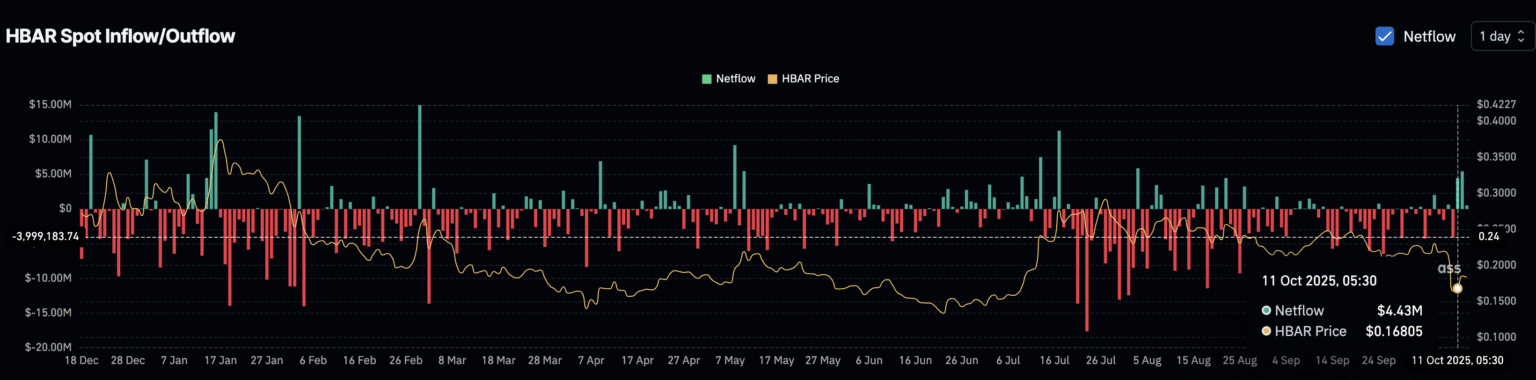

- Reduced Selling Pressure – Data indicates that large and small holders are holding onto their tokens amid speculation of rising future values, influenced by positive developments within the Hedera network and broader adoption scenarios.

- Increased Network Adoption – HBAR’s utility is enhanced by its growing adoption in developing decentralized applications (dApps). Companies and services adopting Hedera’s technology are expanding, contributing to its credibility and token demand.

- Strategic Partnerships – Hedera has continually announced partnerships that enhance its visibility and integration into significant sectors, adding to investor confidence.

Technical Analysis

From a technical perspective, HBAR has demonstrated resilience. After breaking through a critical resistance level, the token has been testing various support levels. Technical analysts note that with reduced sell-off pressure, these levels could potentially serve as launchpads for further price gains.

Following the dip to a low support level, seen commonly across several cryptocurrency platforms, HBAR has rebounded, showing significant recovery. Chartists observing the Moving Average Convergence Divergence (MACD) note a bullish crossover, suggesting that the momentum could swing positively in the short to medium term.

Price Targets and Market Sentiment

With the renewed interest and positive sentiment, market analysts have revised their price targets for HBAR. Although predictions vary, the consensus is optimistic, with many believing that if the current support level holds, HBAR could climb to new heights in the upcoming months, possibly reaching previous highs.

The sentiment in trading forums and investment circles has shifted from cautiously observant to optimistically speculative. Investors are particularly intrigued by the efficiency and the low transaction fees of the Hedera network, which could challenge more established cryptocurrencies if adoption continues to grow.

Future Perspectives

Looking forward, the direction of HBAR’s price will significantly depend on continued technological development and adoption. With blockchain and crypto increasingly becoming mainstream in various applications—from finance to supply chain logistics—the potential for Hedera Hashgraph to secure a substantial position in this space is apparent.

As with any investment in the volatile crypto market, potential investors are advised to conduct their research and consider the technology’s utility and market trends. Current movements suggest a growing confidence, but as experienced market watchers would note, vigilance remains crucial.

In summary, as selling pressures decrease and Hedera Hashgraph continues to build its market presence through strategic advancements, the rebound in HBAR’s price targets is not just a short-term rally but potentially the beginning of a steadier climb to prominence in the crypto space.