The name Garrett Jin has recently captured the attention of the trading community, leading to speculation about his identity as a so-called “whale” in the markets. This term refers to individuals or entities that hold significant positions, capable of influencing market movements. Jin’s presence in the trading sphere is shrouded in mystery, prompting many to wonder about his strategies and the impact he has on financial trends.

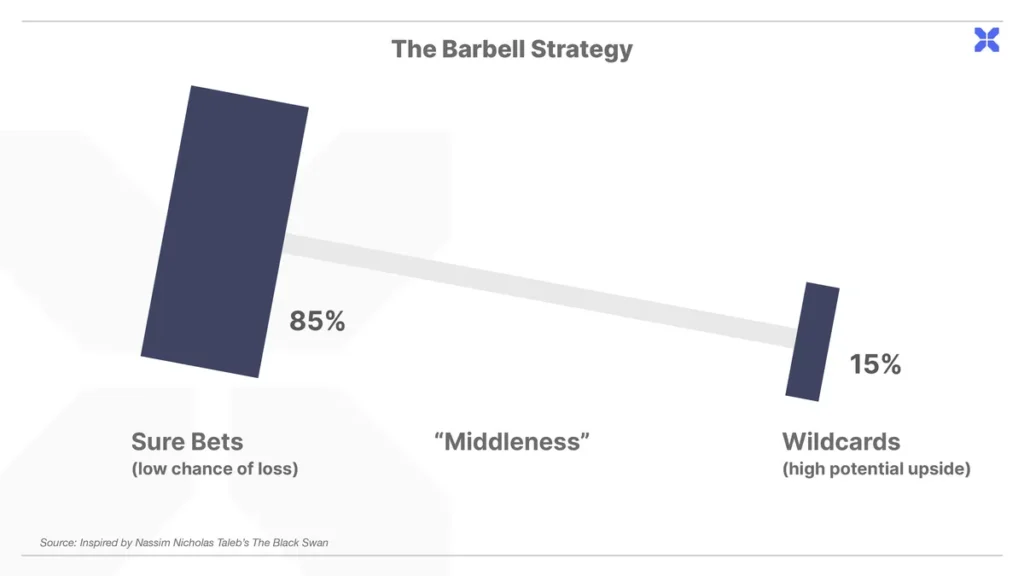

As a black swan trader, Jin is associated with making bold moves that can lead to unexpected market shifts. The term “black swan” itself denotes rare events that have profound effects, often beyond typical forecasting models. This characterizes a trading style that is not just reactive but also anticipative of events that others may overlook.

The intrigue surrounding Garrett Jin stems not only from his trading prowess but also from the lack of publicly available information about him. This anonymity adds an element of allure, inspiring curiosity among traders and analysts alike. Many are eager to understand the mechanisms behind his decisions and the rationale that guides his significant investments.

In the broader context of trading, the actions of individuals like Jin can have far-reaching implications. Their strategies may serve as a benchmark or a cautionary tale for others navigating the volatile terrain of financial markets. The fascination with such figures highlights the complexities of trading and the unpredictable nature of market dynamics.

As discussions around Garrett Jin continue, the community remains engaged in attempting to decode the motivations and methods that drive such high-stakes trading behaviors. Whether he will maintain his enigmatic status or reveal more about his trading philosophies remains to be seen, but the interest in his activities is undeniable.