Tether and Circle Invest Capitalize on Market Trends During ‘Buy The Dip’ Phase Over the Weekend

In the fast-paced world of cryptocurrency, strategic moves by major players like Tether and Circle Invest often set the tone for market dynamics. Over the recent weekend, both companies maneuvered to make the most of the ‘Buy The Dip’ sentiment that surged through the market, indicating a proactive approach in a volatile financial environment.

Understanding the ‘Buy The Dip’ Phenomenon

Buying the dip refers to purchasing an asset after it has dropped in price, with the expectation that a rebound is on the horizon. This strategy is common in stock trading and has become increasingly popular in cryptocurrency markets, where price swings can be sudden and significant. It’s based on the assumption that what goes down will eventually rise, especially if the asset’s fundamentals remain strong or the overall market trend is bullish.

Tether’s Strategy Amidst Market Volatility

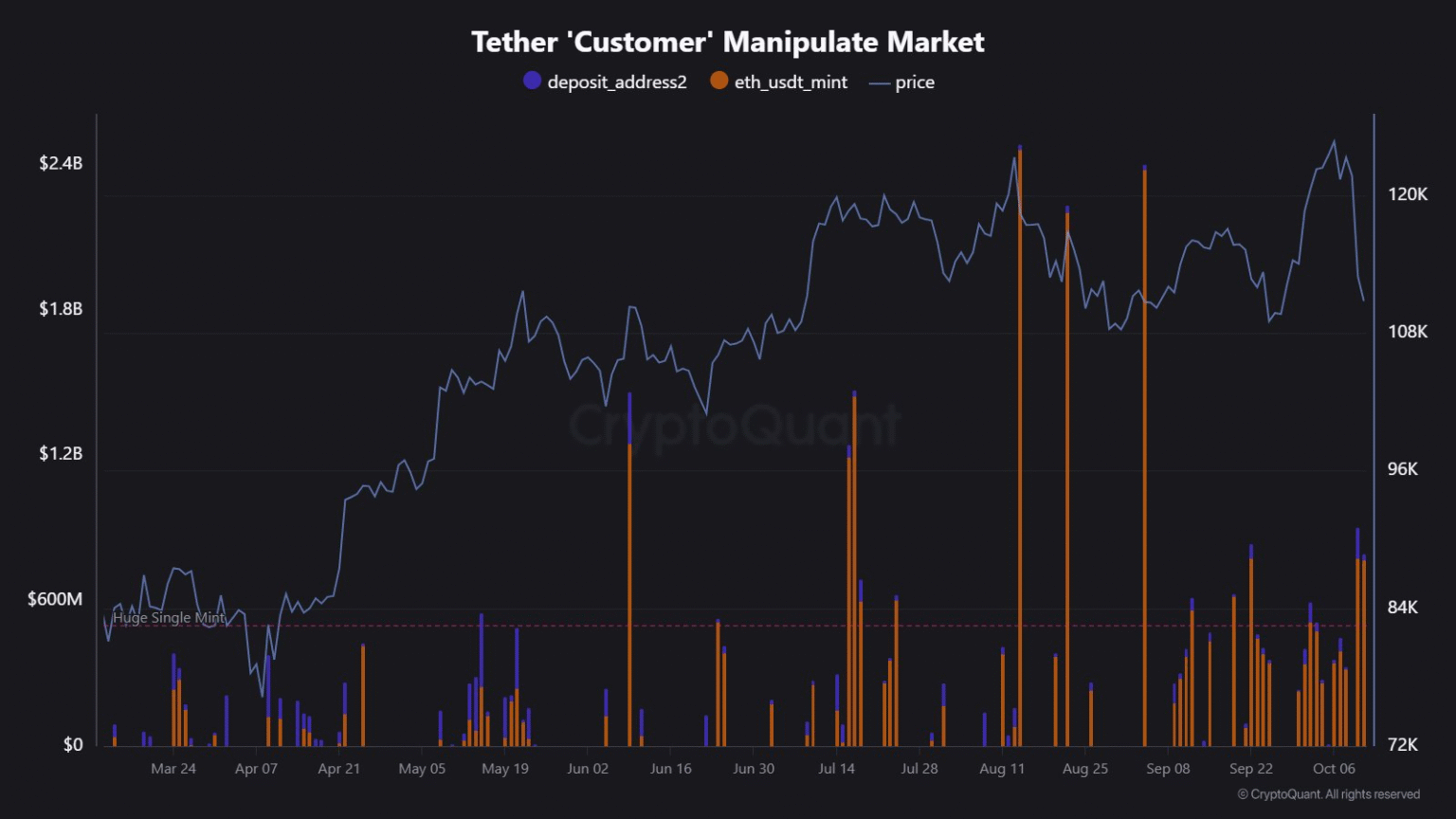

Tether, the organization behind USDT, the world’s largest stablecoin pegged to the US dollar, played a crucial role during the recent downturn and subsequent recovery. As crypto prices tumbled, investors and traders sought refuge in USDT, leveraging its stability against the high volatility of other tokens. Observing the increased transaction volumes and inflows into USDT, Tether ensured liquidity was maintained, reinforcing its pivotal position in the market.

Moreover, Tether’s constant minting of USDT in response to demand likely provided a cushion against further market drops, aiding in stabilizing market conditions. This activity not only supports the market during dips but also reinforces investor confidence in Tether’s ability to manage its token supply effectively amidst turbulent market conditions.

Circle Invest’s Active Engagement in the Dip

Circle Invest, the retail investment platform from Circle, showcased a proactive approach during the market’s dip. The platform, known for its user-friendly design and gateway to cryptocurrencies like Bitcoin and Ethereum, saw a noticeable uptick in activity. Circle leveraged its analytics tools to guide both new and seasoned investors through the volatile periods, encouraging them to ‘buy the dip’ safely.

Their recent educational initiatives and real-time transaction capabilities likely contributed to increased investor participation. By providing timely data and analysis, Circle Invest helped demystify the complexities of the dip-buying process, allowing users to make more informed decisions.

Market Response and Future Outlook

The response from the broader market was palpable. As investors flocked to platforms like Tether and Circle Invest to capitalize on lower prices, there was a mild rebound in many cryptocurrencies by the close of the weekend. This illustrated the significant influence that major entities in the crypto space can exert over market sentiment and movements.

Looking ahead, while the strategy of buying the dip can offer opportunities for gains, it comes with risks. Cryptocurrency markets remain notoriously volatile, and regulatory uncertainties continue to loom large. Both Tether and Circle Invest appear poised to continue adapting their strategies to meet these challenges and potentially shape the trajectory of the crypto market further.

Conclusion

The actions taken by Tether and Circle Invest during recent market fluctuations highlight the important roles that these platforms play in the broader ecosystem. By ensuring stability and providing necessary resources for informed trading decisions, they help maintain market order and offer avenues for investors to capitalize on volatility. As the crypto landscape evolves, the strategies employed during these crucial moments will be instrumental in steering future market directions.