Trump Eases Worries Over China, Bitcoin and Ethereum Rally

In a surprising turn of events, recent comments made by former President Donald Trump have reassured investors worldwide, leading to significant positive movements in both the cryptocurrency and stock markets. Specifically, Bitcoin and Ethereum, two of the largest cryptocurrencies by market capitalization, have rallied following Trump’s remarks.

During a televised interview on Tuesday, Trump spoke about the U.S.-China relations, highlighting his administration’s efforts in building a “phase one” trade deal and suggesting that the groundwork laid during his tenure could foster better economic interactions and reduced tensions between the two world powers. His conciliatory tone marked a notable shift from his previous, more confrontational stance, which included tariffs and tough rhetoric against China.

Trump’s comments come at a time when global economies are still grappling with the implications of the COVID-19 pandemic, and his optimistic outlook provided a much-needed boost to investor confidence. This reassurance is critical as it comes amid escalations between the U.S. and China in other areas, particularly technology and security.

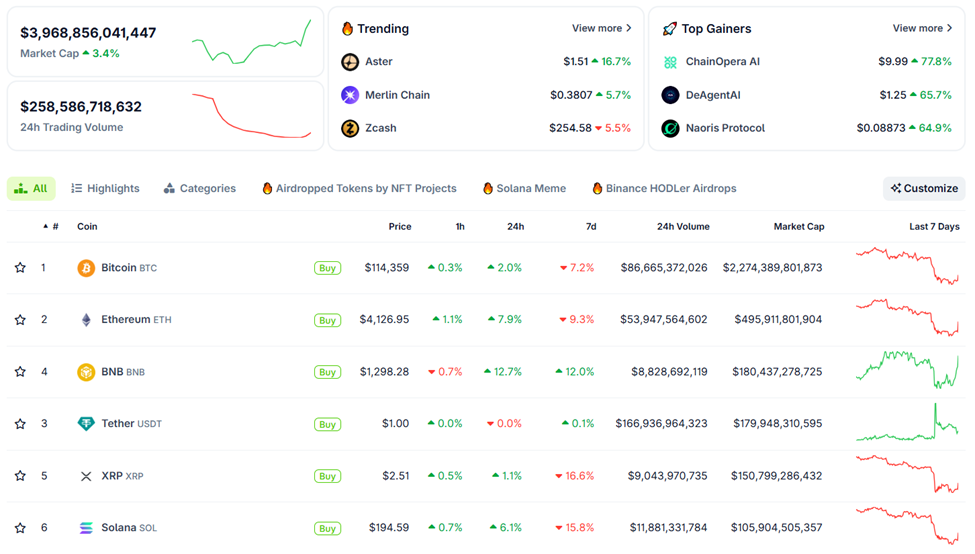

Following Trump’s interview, stock markets saw a positive uptick, particularly in sectors closely tied to U.S.-China trade relations. However, more noteworthy was the swift reaction in the cryptocurrency markets. Bitcoin and Ethereum, which had been experiencing a period of volatility amid regulatory concerns and market speculation, both surged.

Bitcoin, often considered a “safe-haven” asset in times of economic uncertainty, rebounded from its recent lows to climb more than 10% in a matter of hours. Ethereum, gearing up for its long-anticipated upgrade, followed suit with a similar upward trajectory.

Analysts believe Trump’s words have played a role in alleviating some of the market uncertainties that have loomed over the cryptocurrency sector, especially concerning the U.S.’ regulatory stance on digital assets. The apparent easing of geopolitical tensions and the prospect of stable trade relations make a favorable backdrop for riskier assets like cryptocurrencies.

Furthermore, investors are possibly interpreting Trump’s positive sentiments as a sign of stability in international markets, which is crucial for high-risk investments including but not limited to cryptocurrencies. The calming effect this has on the market cannot be understated, especially after the tumultuous periods recently fueled by regulatory crackdowns and tech selloffs.

Trump’s influence on market dynamics is not new; throughout his presidency, his tweets and public comments often led to immediate market reactions. What is interesting in this scenario is the continued impact of his opinions even though he is no longer in office, underscoring his residual influence on both political and economic arenas.

While the long-term impact of his statements is yet to be seen, for now, markets are enjoying some respite from the bears. As both the U.S. and China navigate the complex web of diplomacy and economics, the global investor community remains keenly tuned to the developments, hopeful that further improvements in the relationship will continue to bolster market sentiment.

Investors and market enthusiasts will be watching closely to see how sustained this rally can be and what other factors might influence these key markets in the weeks and months to come. With the landscape of global trade and digital currencies rapidly evolving, insights like those from Trump can continue to spark significant market movements.