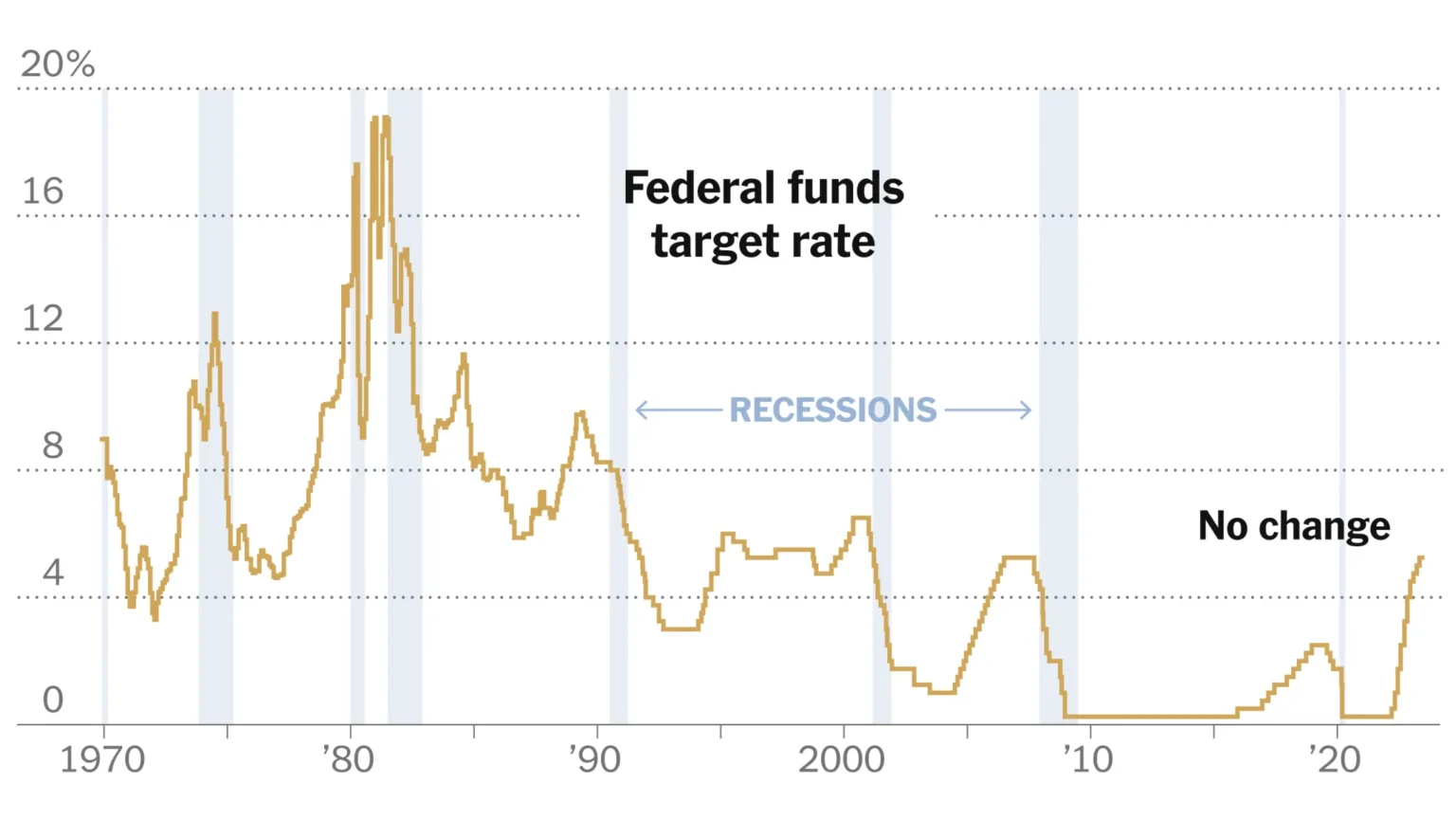

The likelihood of the Federal Reserve implementing a 25 basis point cut to interest rates in October stands at an impressive 98.3%. This high probability indicates that market participants are largely anticipating a shift in monetary policy aimed at stimulating economic activity. A reduction in interest rates can have significant implications for various sectors, including consumer spending, business investments, and overall economic growth. As the Federal Reserve considers its options, the potential for a rate cut reflects ongoing assessments of economic conditions and inflationary pressures. Investors and analysts alike are closely monitoring these developments, as a rate cut could influence borrowing costs and financial markets. The anticipation surrounding this decision underscores the importance of the Federal Reserve’s role in shaping economic policy and responding to changing economic landscapes.

Previous ArticleAncient BTC Whale Deposits 300 BTC to CEX from MtGox Funds

Related Posts

Add A Comment