Ethereum Price Drop Offers a 13% Rebound Potential: Analyzing the Factors and Opportunities

Recently, the cryptocurrency market has witnessed a significant price dip in Ethereum (ETH), one of its premiere cryptocurrencies. This decline in Ethereum’s value has sparked interest among investors and traders alike, as it suggests a possible rebound opportunity with an estimated potential of up to 13%. This article delves into the reasons behind the price drop, the catalysts for a potential rebound, and strategic approaches for investors considering capitalizing on these market movements.

Analyzing the Reasons Behind Ethereum’s Price Dip

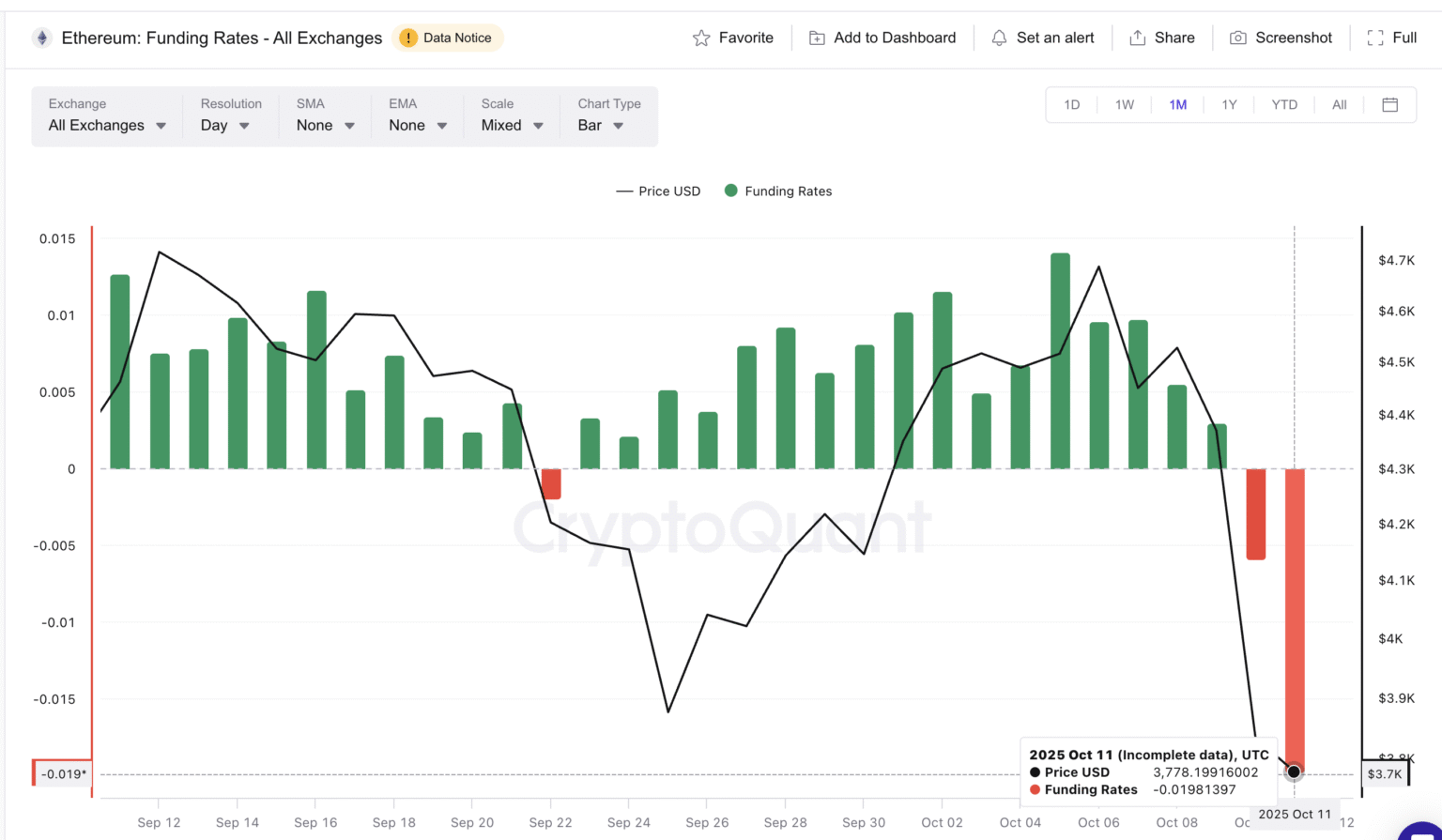

The recent downturn in Ethereum’s price can be attributed to a mix of macroeconomic factors, shifts in the crypto ecosystem, and market sentiment. Firstly, global economic pressures such as inflation rates, changes in interest rates by major central banks, and geopolitical uncertainties have led to a more risk-averse stance among investors. Secondly, within the crypto space, the transition of Ethereum to Ethereum 2.0, though promising, has brought with it uncertainties and technical challenges that have caused short-term bearish sentiments. Additionally, the general volatility of the cryptocurrency markets often leads to sharp price movements following broader economic indicators or significant news within the industry.

Catalysts for a Potential Rebound

Despite the drop, Ethereum holds strong fundamentals that could fuel a potential rebound:

-

Adoption of Ethereum 2.0: The upgrade to Ethereum 2.0 marks a significant improvement in its blockchain technology, transitioning from proof-of-work (PoW) to proof-of-stake (PoS). This change not only enhances transaction speed and efficiency but also addresses major environmental concerns related to the energy consumption of traditional mining practices. As more users understand and experience the benefits of Ethereum 2.0, confidence and adoption are likely to increase, pushing the price upwards.

-

Institutional Interest: Ethereum continues to see growing interest from institutional investors who are increasingly considering cryptocurrencies as a legitimate asset class. This institutional interest can provide more stability to Ethereum’s price and fuel a rebound as companies and large investors continue to diversify their portfolios with digital assets.

-

Innovative Decentralized Applications (DApps): Ethereum is the backbone for numerous decentralized applications across various sectors including finance, art, and governance. The continuous innovation and the success of these DApps contribute positively to the intrinsic value of Ethereum. As these technologies mature and gain more mainstream acceptance, they could significantly impact Ethereum’s price positively.

- Market Corrections and Sentiment Shifts: The crypto market is known for its rapid sentiment shifts. Current bearish trends can quickly pivot to bullish trends with positive news or market developments, leading to swift price recoveries.

Investment Strategies

For investors eyeing the 13% rebound potential in Ethereum, here are several approaches:

-

Long-term Holding (HODLing): Given Ethereum’s strong fundamentals and growth potential with upcoming technological advancements, a long-term hold strategy could be beneficial.

-

Dollar-Cost Averaging (DCA): This strategy involves buying a fixed dollar amount of Ethereum at regular intervals. It reduces the impact of volatility and lowers the risk of investing a large amount at an unfavorable price.

- Technical Analysis and Trading: For more seasoned traders, utilizing technical analysis tools to identify entry and exit points can be crucial. Keeping an eye on support and resistance levels could aid in maximizing gains.

Conclusion

The recent dip in Ethereum’s price presents a notable rebound opportunity for cautious investors and seasoned traders alike. Understanding the underlying reasons for price movements, staying abreast of market developments, and applying a disciplined investment strategy can potentially lead to profitable outcomes. As always, in the volatile world of cryptocurrencies, it is vital to conduct thorough research and consider personal risk tolerance before making investment decisions.