$3.8 Billion Fund Tokenized on BNB Chain: China’s Most Audacious Move in the Blockchain Arena

In an unprecedented move that signifies China’s bold stride within the blockchain universe, a massive $3.8 billion fund has recently been tokenized on the BNB Chain. This marks a not only substantial financial investment into the blockchain space but also indicates a significant pivot in China’s regulatory and technological approach towards decentralized finance (DeFi).

Tokenization: A Revolution in Asset Management

Tokenization is the process of converting rights to an asset into a digital token on a blockchain. The concept itself isn’t novel, but its application at the scale of billions of dollars represents a major leap forward. By tokenizing such a large fund, China is endorsing the idea that blockchain technology can instill enhanced security, transparency, and efficiency in asset management.

The $3.8 billion in question will likely encompass a variety of assets, from real estate holdings to securities or bonds. This isn’t just about digital transformation; it’s about creating a more liquid, frictionless market where assets can be bought, sold, or traded at unprecedented speeds and with reduced costs.

BNB Chain: The Platform of Choice

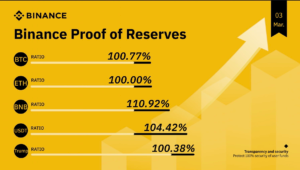

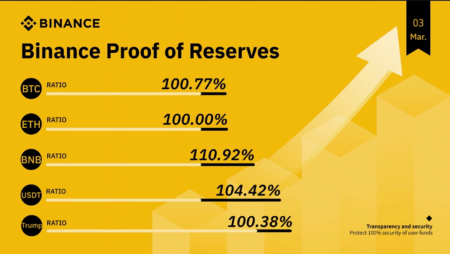

The decision to tokenize this fund on the BNB Chain is equally significant. BNB Chain, formerly known as Binance Smart Chain, is known for its high-throughput, scalable architecture, making it a robust platform for handling large-scale transactions consistent with DeFi applications. Opting for BNB Chain illustrates a strategic choice likely influenced by its compatibility with Ethereum tools and lower transaction fees, providing a conducive environment for developers and investors alike.

Strategic Implications for China

This strategic move is multi-faceted:

Regulatory Framework

China’s journey with blockchain technology and cryptocurrencies has been notably turbulent, with the government banning cryptocurrency trading and mining in previous years. However, the tokenization of a $3.8 billion fund may suggest a softer stance towards blockchain, albeit under a controlled and regulated framework. It reflects a nuanced approach to leverage the benefits of decentralized technologies while mitigating associated risks such as money laundering and financial volatility.

Economic Vision

Tokenizing such a substantial fund highlights China’s commitment to securing a lead in the global digital economy race. It positions China as a forward-thinking nation that’s not only embracing but also shaping the future of financial technology.

Innovation and Technological Leadership

Beyond economic factors, this move places China at the forefront of blockchain innovation. It can serve as a benchmark for other nations and large entities looking to explore the vast potentials of blockchain technology in public and private sector applications. Moreover, it fosters a domestic tech ecosystem hungry for blockchain developments, potentially leading to home-grown innovations and expertise.

Global Blockchain Dynamics

China’s venture into tokenization at this scale could rejig global dynamics concerning blockchain and digital assets. As nations and corporations watch this experiment unfold, it could prompt a series of tokenization trials across various sectors worldwide.

Moreover, it raises pertinent questions about the global financial system’s future structure, especially about how sovereign nations interact with the burgeoning digital asset classes. The tokenized fund might also spark discussions around international regulations, security standards, and cross-border transaction protocols within the blockchain framework.

Conclusion

The tokenization of a $3.8 billion fund on BNB Chain is not just a financial maneuver but a strategic, regulatory, and technological milestone for China. It encapsulates the potential of blockchain technology in reshaping asset management and possibly the broader economic landscape. For blockchain enthusiasts and economic strategists alike, this development will be closely watched as it unfolds new realms of possibilities in the digital world.

Last updated on October 19th, 2025 at 08:55 pm