Month: 1 day ago

The CME Group proprietary token represents a transformative step in the world of digital finance, as the Chicago-based derivatives exchange is actively exploring its issuance to enhance the collateral and margin ecosystem.This innovative digital asset aims to leverage tokenized assets to bolster market confidence and streamline transactions across financial markets.

The iPhone Fold, Apple’s highly anticipated entry into the foldable smartphone market, has consumers buzzing with excitement and speculation.For years, rumors have circulated about this innovative device, particularly with new leaks suggesting a possible launch in 2026.

In a bold move, President Donald Trump has nominated Kevin Warsh as the next Chair of the Federal Reserve, a decision that is generating significant interest in financial circles.Warsh, a former member of the Fed Board of Governors, brings extensive experience from his tenure during the 2008 financial crisis, offering valuable insights into economic challenges.

The XRP market downturn has sent ripples through the cryptocurrency landscape, leading to a significant price drop that saw XRP plummet near $1.5 during a widespread cryptocurrency selloff.This alarming decline was responsible for over $2.5 billion in liquidations, reflecting the depth of the ongoing crypto market volatility.

Hyperliquid is making waves in the crypto trading landscape with its innovative approach, recently highlighted by a notable transaction involving an impressive deposit of 4 million USDC.In this intriguing instance, a new address injected this significant capital into the platform, subsequently taking a short position on SOL using 3x leverage.

The latest fluctuations in the crypto market have caused the Solana price to drop significantly, reaching lows of $96, marking a pivotal moment for the digital asset.This decline follows a wave of investment outflows from digital asset products, with Solana witnessing over $31 million in net withdrawals just last week, the first such downtrend in three weeks.

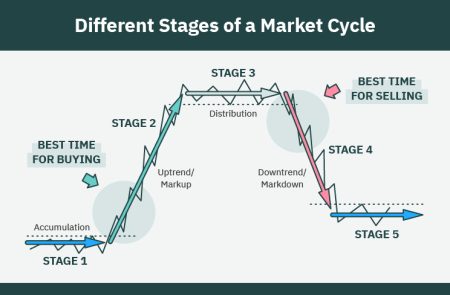

The Bitcoin bear market has become a hot topic among crypto enthusiasts and investors, as analysts debate the implications of current market conditions.With the Bitcoin price trend showing a significant decline from its peak, many industry experts suggest that we may be in for a prolonged bearish phase that could last well into 2026.

The SUI price prediction is taking center stage as the cryptocurrency market faces a significant downturn, prompting traders to closely monitor SUI’s performance.With the recent announcement of SUI/USD trading on the HashKey Exchange, a prominent crypto platform in Hong Kong, sentiments are shifting despite the prevailing bearish trend.

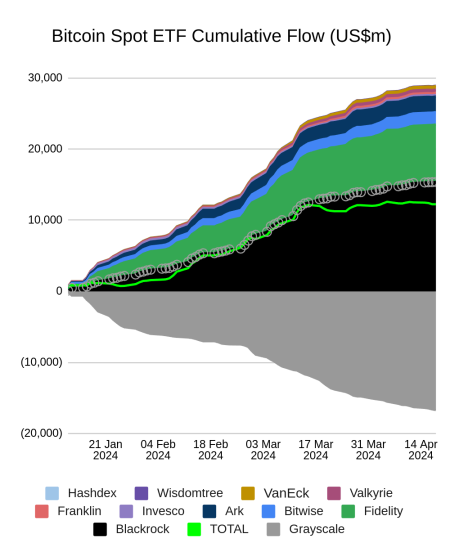

Recent activity in the Bitcoin market has raised eyebrows, particularly concerning the rising Bitcoin ETF outflow which has seen over $2.9 billion exit these exchange-traded funds in just 12 days.This significant withdrawal highlights a bearish sentiment emerging as traders react to broader cryptocurrency trends and pressures from the futures market.

Market cycle performance plays a pivotal role in understanding the dynamics of cryptocurrency investments, especially as we step into a new phase of market evolution.Zhu Su, the founder of Three Arrows Capital, highlights the importance of recognizing potential asset rotation paths through “analogical reasoning.” His insights suggest that the upcoming trends could reveal how ETH’s performance may mirror BTC’s success in prior cycles.