Month: 20 hours ago

Bitcoin price prediction is currently a hot topic among investors as the cryptocurrency struggles to maintain its foothold in a volatile market, having recently dipped to a critical low of $72,169.Analysts are closely watching Bitcoin analysis and chart patterns to gauge potential market recovery, especially as prices hover around significant support levels.

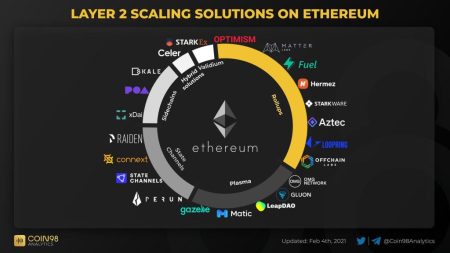

Ethereum Layer 2 solutions represent an innovative leap in the quest for Ethereum scaling, addressing the network’s notorious gas fees and enhancing transaction throughput.As the cryptocurrency landscape evolves, Vitalik Buterin’s vision for Layer 2 has shifted, emphasizing the need for differentiated rollup decentralization rather than a homogenous approach.

In a significant move within the cryptocurrency market, a major whale has purchased 2,500 cbBTC, amounting to an impressive $182 million within the past 8 hours.This substantial transaction has caught the attention of investors as cbBTC news circulates, highlighting notable whale transactions that could influence market dynamics.

Kyle Samani Multicoin, the co-founder of the prominent crypto investment firm Multicoin Capital, recently announced his decision to step down from his managing partner role after a remarkable ten-year journey in the blockchain space.This bittersweet moment marks the end of an era, as Samani expressed a desire to take time off to delve into exciting new avenues, particularly in AI and robotics.

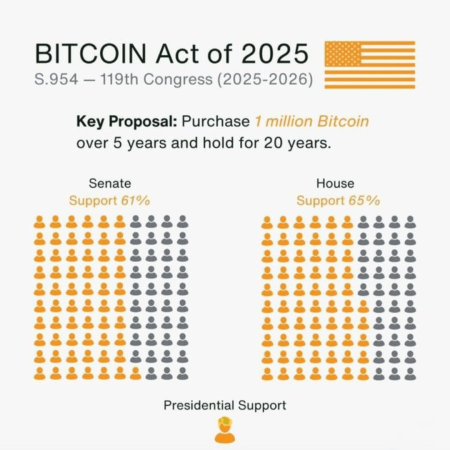

The U.S.Bitcoin policy is shaped by a firm stance from government officials regarding the cryptocurrency’s role in the financial landscape.

The recent Chiliz price drop has sent shockwaves through the cryptocurrency community, with a staggering decline of over 15% pushing the value down to lows of $0.046.This significant price drop reflects broader market instability, primarily influenced by a sharp downturn in Bitcoin and its subsequent ripple effects on altcoin performance.

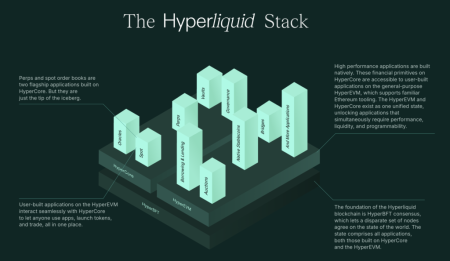

Hyperliquid has distinguished itself in the crypto landscape, achieving a remarkable double-digit price surge while many major cryptocurrencies, such as Bitcoin and XRP, struggle amidst a prevailing bear market.The HYPE token, a fundamental part of Hyperliquid’s ecosystem, has soared approximately 71% to reach a peak of $35, marking the highest valuation since last December.

Recently, President Trump made headlines with his comments on the Federal Reserve, particularly regarding his former nominee Kevin Warsh and his stance on interest rates.In an exclusive interview, Trump claimed that had Warsh been open to increasing interest rates, he would never have considered him for the role of Federal Reserve chairman.

In a recent Congressional testimony, US Treasury Secretary Scott Bessent stated unequivocally that the US will not engage in a “Bitcoin bailout,” reaffirming the government’s stance on the cryptocurrency ecosystem.Bessent emphasized that while the Treasury will retain the Bitcoin acquired through asset seizures, it will not intervene in the market by directing private banks to purchase more Bitcoin amidst economic fluctuations.

The recent decline in the OP token price has raised eyebrows among investors, especially after the approval of Optimism’s buyback plan.Despite this seemingly positive development, the token’s value has plummeted by approximately 8.8% in just 24 hours, reflecting a broader trend of risk-off sentiment affecting high-beta altcoins within the volatile crypto market.