Month: 20 seconds ago

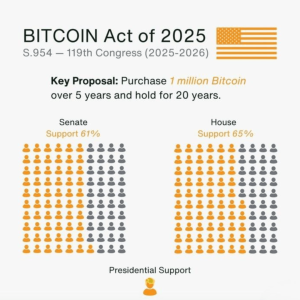

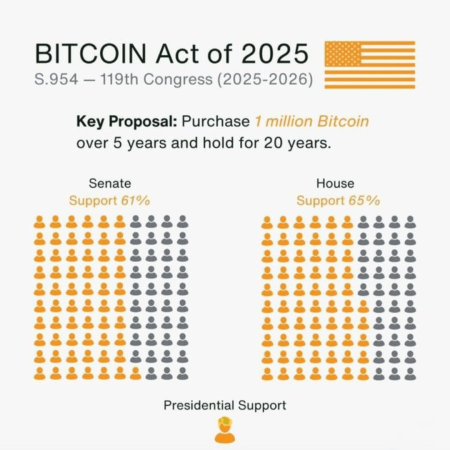

The U.S.Bitcoin policy is shaped by a firm stance from government officials regarding the cryptocurrency’s role in the financial landscape.

The recent Chiliz price drop has sent shockwaves through the cryptocurrency community, with a staggering decline of over 15% pushing the value down to lows of $0.046.This significant price drop reflects broader market instability, primarily influenced by a sharp downturn in Bitcoin and its subsequent ripple effects on altcoin performance.

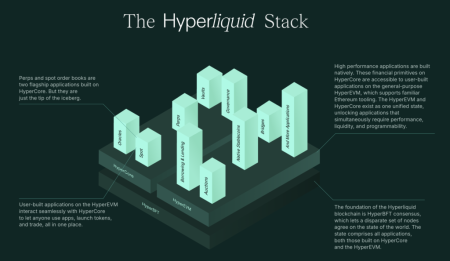

Hyperliquid has distinguished itself in the crypto landscape, achieving a remarkable double-digit price surge while many major cryptocurrencies, such as Bitcoin and XRP, struggle amidst a prevailing bear market.The HYPE token, a fundamental part of Hyperliquid’s ecosystem, has soared approximately 71% to reach a peak of $35, marking the highest valuation since last December.

Recently, President Trump made headlines with his comments on the Federal Reserve, particularly regarding his former nominee Kevin Warsh and his stance on interest rates.In an exclusive interview, Trump claimed that had Warsh been open to increasing interest rates, he would never have considered him for the role of Federal Reserve chairman.

In a recent Congressional testimony, US Treasury Secretary Scott Bessent stated unequivocally that the US will not engage in a “Bitcoin bailout,” reaffirming the government’s stance on the cryptocurrency ecosystem.Bessent emphasized that while the Treasury will retain the Bitcoin acquired through asset seizures, it will not intervene in the market by directing private banks to purchase more Bitcoin amidst economic fluctuations.

The recent decline in the OP token price has raised eyebrows among investors, especially after the approval of Optimism’s buyback plan.Despite this seemingly positive development, the token’s value has plummeted by approximately 8.8% in just 24 hours, reflecting a broader trend of risk-off sentiment affecting high-beta altcoins within the volatile crypto market.

In today’s digital landscape, online age verification has emerged as a focal point of discussion, particularly with the new age verification laws cropping up across various nations.As governments seek to implement measures for protecting minors, these laws often carry significant implications for online privacy and free expression.

Polymarket website visits have been experiencing a significant surge, making it a notable player among crypto trading platforms.Recent insights from Nick Tomaino, founder of 1confirmation, reveal that this decentralized prediction market is outpacing its counterparts like Robinhood and Coinbase, which are currently witnessing a decline in monthly traffic.

The CME Group proprietary token represents a transformative step in the world of digital finance, as the Chicago-based derivatives exchange is actively exploring its issuance to enhance the collateral and margin ecosystem.This innovative digital asset aims to leverage tokenized assets to bolster market confidence and streamline transactions across financial markets.

The iPhone Fold, Apple’s highly anticipated entry into the foldable smartphone market, has consumers buzzing with excitement and speculation.For years, rumors have circulated about this innovative device, particularly with new leaks suggesting a possible launch in 2026.