Month: 4 weeks ago

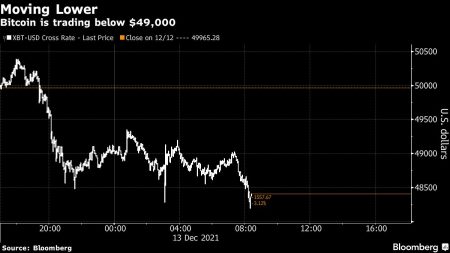

The recent BTC price drop has sent ripples through the cryptocurrency market, as Bitcoin tumbles below the critical threshold of 89,000 USDT.Fresh insights from OKX market data reveal that Bitcoin is now trading at approximately 88,960 USDT, reflecting a 24-hour decline of 1.24%.

Robert Kiyosaki’s wealth accumulation strategies have inspired millions around the globe.As the author of the best-selling book “Rich Dad Poor Dad,” he emphasizes the importance of investing in tangible assets such as gold and silver.

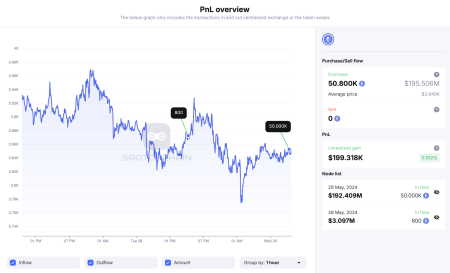

Whale trading losses have recently made headlines in the cryptocurrency market as major players navigate volatile conditions.A notable case involves a crypto whale that shorted 255 BTC, leading to the closure of long positions in BTC, Ethereum, and SOL, ultimately incurring a staggering loss of $2.86 million.

SPACE cryptocurrency is making waves in the digital currency market, with its price briefly breaking through the 0.03 USDT mark.Currently, the SPACE coin price sits at approximately 0.024 USDT, reflecting a notable interest from traders and investors alike.

The Kansas Bitcoin reserve fund is emerging as a pivotal initiative among lawmakers, as they navigate the complexities of Kansas Senate Bill 352.This groundbreaking legislation aims to create a reserve fund for Bitcoin and other digital assets, utilizing funds from unclaimed property rather than engaging in direct cryptocurrency purchases.

Binance futures is revolutionizing the world of crypto trading with the upcoming launch of two major perpetual contracts: SPACEUSDT and FIGHTUSDT.Scheduled for January 23, 2026, these contracts will provide traders with the opportunity to leverage their positions up to 20 times, substantially amplifying their potential returns.

In recent cryptocurrency market news, the notable whale withdrawal of 1.34 billion PUMP from the OKX exchange has sparked considerable interest among traders and investors alike.This substantial transaction, valued at approximately $3.31 million, has made waves, especially as the whale now possesses a total of 2.8 billion PUMP tokens, amounting to a staggering $6.92 million.

In a significant move within the cryptocurrency landscape, Metalpha ETH withdrawal has made headlines as the company retrieves a substantial amount of Ethereum.Recently, Metalpha executed a withdrawal of 8,500 ETH, equating to an impressive $24.85 million, from major exchanges including Kraken and Binance.

In the ever-evolving landscape of cryptocurrency investments, the top 25 BTC holdings represent a crucial benchmark for publicly traded companies vying for a competitive edge.Recent data reveals that the threshold to enter this prestigious group has escalated, with firms now needing to possess over 4,000 bitcoins to make the list.

Financial balance is a crucial aspect of achieving long-term prosperity and well-being.Striking the right equilibrium between saving and spending can significantly impact your earning potential and investment strategies.