Month: 3 weeks ago

The U.S.Cryptocurrency Market Structure is undergoing significant scrutiny as recent discussions around the CLARITY Act rise to the forefront.

Recent developments in Bitcoin ETF inflows have captured the attention of investors, suggesting a growing confidence in the cryptocurrency’s long-term potential.Notably, BlackRock’s Bitcoin Spot ETF has managed to bring in over $6 billion, highlighting a stark contrast to other funds like the silver ETF, which has seen limited success with just $1 billion in inflows.

PENDLE tokens have recently made headlines as they surged into the spotlight following a significant transaction reported by Odaily Planet Daily.The cryptocurrency, which powers Pendle Finance, saw a substantial deposit of 1.8 million tokens, valued at approximately 3.61 million dollars, made to the Bybit cryptocurrency exchange.

AI adjudication in prediction markets is rapidly emerging as a game-changer, addressing key challenges in the determination of outcomes, which is essential for accurate pricing in these innovative financial environments.As highlighted in discussions around AI in finance, the effectiveness of prediction markets hinges not on merely forecasting future events but on accurately assessing what transpired post-event.

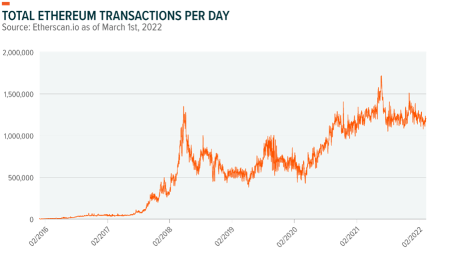

Ethereum transaction volumes have recently captured attention as the network sets remarkable records, handling up to 2.88 million transactions in a single day.This surge in activity highlights not only Ethereum’s capacity for high throughput but also the effectiveness of its Layer 2 Ethereum scaling solutions.

Crypto MEV bots are rapidly emerging as crucial players in the decentralized finance (DeFi) landscape, serving an unexpected role as emergency responders during exploit events.These bots operate on the Ethereum network, where they engage in real-time transaction reordering to mitigate losses from hacks and other disruptions.

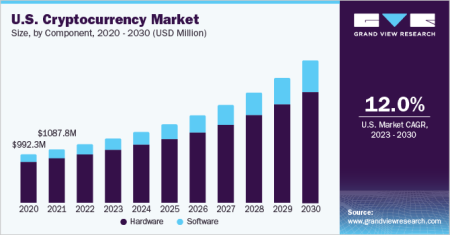

The blockchain ASIC chip has become a pivotal component in the rapidly evolving landscape of blockchain technology, specifically in the mining of cryptocurrencies.AGM Group, a leading research and development firm in this niche, is set to enhance its capabilities by raising $25 million through a private placement of its common stock.

The crypto market 2026 is poised to be a watershed moment for the digital finance landscape, as industry leaders emphasize the need for robust financial infrastructure.Experts like André Casterman predict that the focus will move beyond just the adoption of cryptocurrency, shifting towards tangible frameworks that support the growth of digital assets.

Hong Kong virtual currency fraud is becoming a pressing concern as recent reports highlight alarming cases of investment scams.In a notable incident, a victim lost around 21.4 million Hong Kong dollars after being lured to invest in a seemingly legitimate online trading platform.

ETH Holdings Reduction has captured the attention of market participants as a significant whale adjusts their portfolio amidst fluctuating Ethereum prices.Recently, this major player sold 11,190 ETH, approximately worth $32.83 million, to manage their collateralized ETH USDT position and ensure loan safety.