Month: 1 month ago

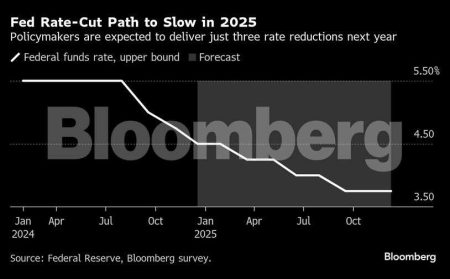

A recent Federal Reserve rate cut has stirred significant conversation among economists and financial analysts, marking a pivotal moment in the current economic landscape.In the latest Fed meeting minutes, officials discussed the implications of this interest rate decision and expressed mixed feelings about further monetary policy adjustments.

Federal Reserve minutes play a crucial role in shaping market expectations, particularly concerning the central bank’s interest rate decisions.Recently published minutes reveal that FOMC members are increasingly inclined towards a dovish outlook, suggesting that further interest rate cuts might be on the table.

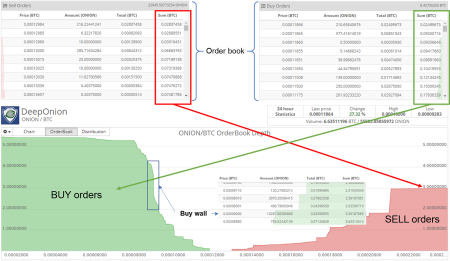

Bitcoin order books play a crucial role in the cryptocurrency trading landscape by revealing the intricate balance of market dynamics at play.Recent analyses highlight how these order books expose the “wild” mechanics that have been suppressing Bitcoin’s rallies, unveiling a market scenario where heavy sell-side liquidity dominates.

Federal Reserve interest rates play a pivotal role in shaping the U.S.economy, with recent decisions made during FOMC meetings sparking significant attention.

The release of the Federal Reserve meeting minutes is a highly anticipated event that can significantly influence financial markets.Following their publication, we witnessed subtle movements in commodity prices, with spot gold and silver showing minimal short-term fluctuations, while the dollar index DXY experienced a slight increase.

Federal Reserve meeting minutes provide essential insights into the central bank’s deliberations on monetary policy and economic conditions.These minutes reveal the discussions surrounding interest rate cuts, which are often considered in the context of managing inflation risks.

The recent surge in the silver price increase has captivated investors and traders alike, as the spot silver price climbed to an impressive $78 per ounce, marking an 8.17% jump for the day.This dramatic rise highlights the current silver market trends, drawing attention from both seasoned traders and those new to silver investment.

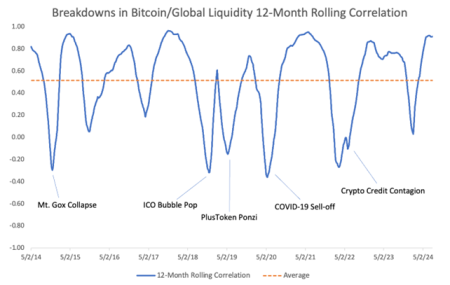

Bitcoin liquidity has become a key topic of discussion in the wake of significant shifts in the cryptocurrency market.Recently, Bitcoin has lost an estimated $2 trillion in its liquidity safety net, leaving the asset vulnerable to unprecedented volatility.

Tether USDT Tron is making headlines as the company has recently minted a staggering 1 billion USDT on the Tron network.This significant issuance reflects Tether’s growing influence in the cryptocurrency sphere, especially as interest in Tether cryptocurrency takes a leap in 2025.

The 2026 XRP outlook presents a complex narrative for investors, as the cryptocurrency currently trades around $1.86 amidst wavering market sentiment and conflicting indicators.The XRP price prediction for 2026 has many speculating on the potential impact of ETF inflows and institutional investments, which have recently shown positive trends despite weak price momentum.