Month: 2 months ago

Ethereum 1CO has recently caught the attention of cryptocurrency enthusiasts as a long-dormant address reactivated after a decade, transferring nearly $120 million in ETH to a new wallet.This revitalization comes at a time when the ETH price increases have captured the interest of investors, highlighting the potential for substantial gains from ICO profits.

The Oracle debt forecast has raised eyebrows lately, especially following a pivotal report from Morgan Stanley.This analysis predicts that Oracle Corporation’s net adjusted debt will skyrocket, potentially exceeding $290 billion by fiscal year 2028, up from the current figure of approximately $100 billion.

In the dynamic world of cryptocurrency trading, an effective ETH trading strategy can make all the difference between profit and loss.Recently, a prominent trader entering long positions on ETH with 5x leverage underscores the potential of this asset, further signifying a total position of approximately $36 million.

In the ever-evolving landscape of digital currency, Frank Giustra Bitcoin gold exchange emerges as a pivotal topic of discussion.Canadian billionaire Frank Giustra has vehemently criticized prominent figures like Michael Saylor, particularly for advocating the sale of gold in favor of Bitcoin, which he deems naive.

The emergence of Grayscale’s Zcash ETF has marked a pivotal moment in the cryptocurrency landscape, bringing the concept of regulated privacy to the forefront of institutional investment.As the first attempt to list a Zcash ETF on NYSE Arca under the ticker ZCSH, this initiative promises to encapsulate the complex interaction between privacy coins and regulatory compliance.

Markets Brace for OPEC-8, ISM and Eurozone Inflation as Fed Succession Chatter Steepens the Curve A crowded macro week puts…

Oil, dollar and yields in the spotlight as OPEC+ meets; PMIs, US ISM and PCE pack a pivotal week for…

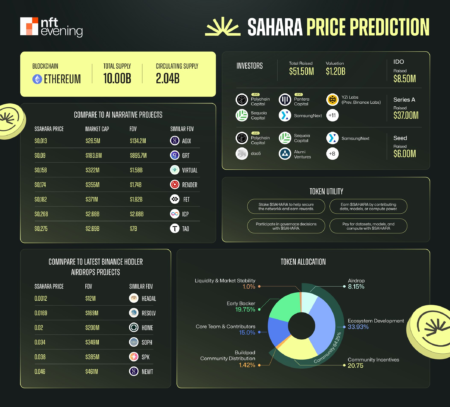

The recent Sahara price drop has sent shockwaves through the cryptocurrency landscape, as the value plummeted over 50% in a remarkably short time.Current reports indicate that Sahara is trading at just $0.03898, raising concerns among investors and traders alike.

In the realm of UK cryptocurrency tax reporting, the landscape is undergoing significant change as the government tightens regulations to enhance compliance measures.Starting January 1, 2026, UK crypto exchanges will be mandated to collect detailed information from traders, aligning with the global Cryptoasset Reporting Framework established by the OECD.

Trump cryptocurrency influence has emerged as a pivotal force shaping the contemporary digital asset landscape, raising eyebrows and concerns alike.As revelations unfold about his extensive crypto holdings, estimated to be valued at an astonishing $11.6 billion, the implications stretch far beyond mere personal wealth.