As we approach the rapidly evolving landscape of 2025 crypto regulations, the financial world stands on the brink of a transformative era. This year marked a significant shift in the regulatory approach to cryptocurrencies, transitioning from a fragmented and uncertain framework to a more coherent system aimed at protecting investors and enhancing market integrity. With the introduction of various global crypto laws in 2025, including focused measures on stablecoin regulations and crypto asset compliance, stakeholders now have clearer guidelines to navigate these digital landscapes. Additionally, crucial discussions around digital dollar regulations have intensified, signaling a new chapter in how monetary policy could intertwine with decentralized finance. As these regulatory changes unfold, understanding their implications is vital for anyone involved in the crypto sphere, ensuring that both individual and institutional players are well-informed and compliant.

In the realm of digital finance, the topic of 2025 crypto regulations encompasses a myriad of changes that are reshaping how cryptocurrencies are governed globally. As industry professionals analyze the latest updates in blockchain legislation and compliance standards, it becomes evident that the framework for managing digital assets is increasingly comprehensive. The evolving protocols surrounding digital currencies, including the intricate regulations targeting stablecoins, reflect a broader trend towards formalizing crypto practices. Furthermore, these legal shifts underline the importance of safeguarding investments while simultaneously fostering innovation within the digital economy. It is essential for both issuers and investors to be well-versed in these regulatory advancements to thrive in this new landscape.

The Impact of 2025 Crypto Regulation Changes

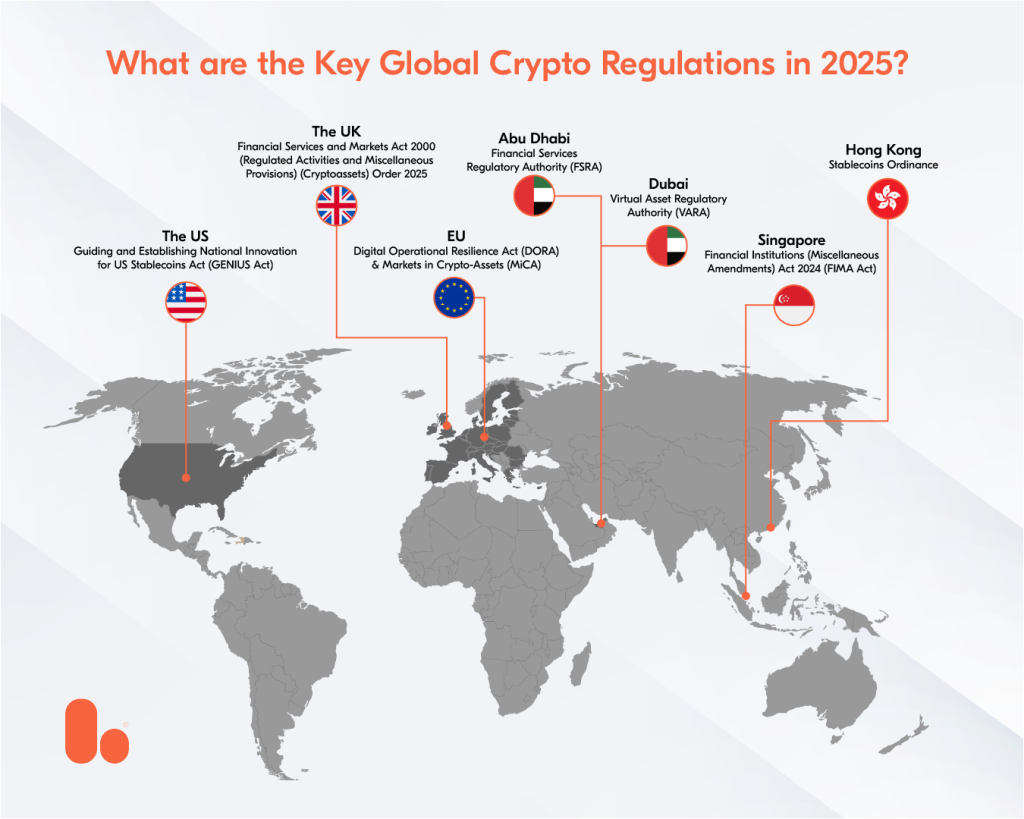

The year 2025 marked a significant shift in the landscape of cryptocurrency regulations, as multiple nations introduced comprehensive frameworks that aimed to protect investors and stabilize the market. These changes came as a response to years of debate and uncertainty surrounding the legal status of digital assets. The new regulations were designed not only to clarify who was responsible for enforcing the rules but also to foster an environment where crypto innovation could thrive under the protection of clear guidelines. With 19 new laws emerging globally, the era of perceived ambiguity surrounding crypto investing was effectively over, paving the way for a more organized and secure marketplace.

Among these transformative regulations, the notable focus on stablecoin regulations demonstrated a recognition of the pivotal role stablecoins play in the crypto ecosystem. By establishing specific rules around their issuance and reserve requirements, regulators aimed to mitigate risks associated with volatility and enhance consumer trust. This regulatory clarity prompted a renewed interest in digital currencies, leading to increased institutional investment and broader adoption by the public. The implications of these regulations resonate through various aspects of the financial system, influencing everything from payment methods to investment strategies.

Navigating the Global Crypto Laws of 2025

As different regions implemented their own regulations in 2025, it became essential for investors and crypto enthusiasts to comprehend the diverse set of laws that emerged. In the United States, regulatory bodies like the SEC and CFTC clarified their respective jurisdictions through acts such as the CLARITY Act and the GENIUS Act. These laws not only defined the roles of regulatory agencies but also provided a structured approach to the oversight of stablecoins and crypto assets. This marked a significant departure from previous governance challenges where overlapping authorities created confusion in the market.

Conversely, in Europe, the EU’s Markets in Crypto-Assets (MiCA) offered a cohesive regulatory framework aimed at harmonizing rules across member states. The focus on Anti-Money Laundering (AML) and investor protection underscored a collective commitment to ensuring financial integrity while fostering innovation. As nations continue to grapple with the complexities of digital asset compliance, understanding these global crypto laws is vital for anyone seeking to engage in the evolving crypto landscape. With knowledge of these regulations, stakeholders can better adapt their strategies to navigate the complexities of international compliance.

The Role of Stablecoin Regulations in 2025

In 2025, stablecoin regulations took center stage as regulatory bodies worldwide recognized the necessity of a robust framework surrounding these digital assets. With stablecoins gaining popularity rapidly due to their price stability and utility in transactions, frameworks such as the GENIUS Act in the U.S. were designed to delineate clear guidelines for their issuance, ensuring that stablecoins are adequately backed by reserves and managed responsibly. This proactive approach not only protected consumers but also encouraged transparency within the industry.

The focus on stablecoins didn’t just stop at issuance; it expanded to include licensing requirements and operational efficiency. In regions like Hong Kong, stringent regulations were enacted to enforce licensing for stablecoin issuers, reflecting the critical need for compliance and market integrity. The convergence of these regulations signifies a global understanding that stablecoins play a vital role in the digital economy, necessitating a balance between innovation and regulation to safeguard parties involved in the cryptocurrency space.

Understanding Digital Dollar Regulations in 2025

The regulatory framework surrounding a potential digital dollar in 2025 emphasized the necessity of clearly defining the parameters under which such a currency would operate. This was an essential step in legitimizing the idea of a centralized digital currency in the broader context of decentralized cryptocurrencies. Regulations aimed to address essential questions about what constituted a digital dollar, how it would be backed, and who would be authorized to issue it. These discussions were pivotal in aligning central bank policies with the rapid evolution of digital assets.

Moreover, the impact of digital dollar regulations could potentially reshape cross-border transactions and the global financial system. By standardizing the rules and establishing frameworks that embrace both innovation and consumer protection, regulators aim to create a cohesive strategy that enhances the efficacy of digital transactions. This harmony between traditional financial channels and digital currencies could result in seamless transactions, reducing costs and fostering global participation in the economy.

Enhancing Crypto Asset Compliance in 2025

As 2025 unfolded, the necessity for stringent crypto asset compliance became increasingly clear. Regulatory bodies recognized the risks that accompany unregulated crypto practices, leading to a wave of compliance measures aimed at protecting both investors and the broader financial ecosystem. Compliance wasn’t merely about following regulations; it was about building trust and ensuring that all market participants are held to high standards. The establishment of clearer guidelines helped demystify the process for crypto asset businesses, allowing them to operate more securely within defined legal frameworks.

The adaptation of compliance measures across different jurisdictions also underlined a collective global effort to create a responsible cryptocurrency market. With developments such as the IRS’s staking guidance and the EU’s AML enhancements, a cross-functional approach emerged, recognizing that compliance should be a shared responsibility among regulators, issuers, and consumers alike. This shift indicates a maturing industry that is increasingly oriented toward accountability and integrity.

Future Trends in Crypto Regulations Beyond 2025

Looking ahead, the trends in crypto regulations emerging from 2025 suggest an ongoing commitment to refining governance structures in the rapidly changing digital market. As technology evolves, regulators must adapt to new challenges, from emerging asset types to innovative financial products. Anticipating these developments will require constant dialogue between stakeholders—regulators, industry leaders, and consumers—to form regulations that not only protect participants but also foster innovation. This proactive approach will help to prevent regulatory lag, ensuring that laws remain relevant and effective.

Additionally, the potential for international cooperation in establishing crypto regulations cannot be overlooked. As cryptocurrencies are inherently transnational, cohesive global regulations may become essential to thwart money laundering and other illegal activities that transcend borders. With numerous countries already voicing their commitment to standardize regulations, we can expect to see a concerted push towards international agreements that align regulatory frameworks across multiple jurisdictions, creating a safer and more predictable environment for users.

The Evolution of Crypto Regulation Frameworks in Key Regions

The evolution of crypto regulations in 2025 highlights different approaches taken by key regions, each seeking to balance fostering innovation with safeguarding consumers. In the United States, the introduction of acts like the CLARITY and GENIUS acts represented an important step toward differentiating between various types of regulatory oversight. By clearly delineating roles between agencies, the U.S. strives to create a more coherent regulatory environment that supports the burgeoning crypto market.

Conversely, the European Union’s implementation of the MiCA regulation showcases a strategy focused on harmonization across member states. This model emphasizes consistency in the regulatory landscape, benefiting businesses operating in multiple countries. With innovation encouraged under a unified framework, the EU presents itself as a competitive landscape for crypto-related enterprises while ensuring that protections for investors remain a top priority.

Crypto Regulation Compliance: Key Takeaways

In navigating the complex dynamics of crypto regulation, it is crucial for investors and businesses to understand the key compliance takeaways from the sweeping changes initiated in 2025. Firstly, a thorough comprehension of specific regulations—ranging from stablecoin frameworks to guidelines on digital asset issuance—is imperative for operating within the bounds of the law. This awareness will not only empower stakeholders to make informed decisions but will also prevent potential legal pitfalls that could arise from non-compliance.

Secondly, engagement with compliance mechanisms and staying informed about legislative updates is vital. The landscape will continue to evolve, necessitating ongoing adjustments to strategies and operations as new laws are enacted. By actively participating in discussions around regulation and compliance, stakeholders can contribute to shaping future policies while safeguarding their interests in the ever-changing world of crypto.

The Future of Crypto Regulations: A Collaborative Approach

The future of crypto regulations appears to be shifting towards a more collaborative framework, where dialogue between regulators, industry leaders, and the public becomes increasingly vital. As the technology behind cryptocurrencies evolves, regulators acknowledge that collaboration can lead to more effective oversight while simultaneously promoting innovation. This approach allows for the insights and experiences of crypto users to inform the development of regulations that are practical and relevant.

Furthermore, as the cryptocurrency space becomes more interconnected globally, the collaboration must extend beyond national borders. International cooperation will be critical in establishing a comprehensive regulatory framework that fosters growth while addressing the challenges posed by digital assets. With various countries taking significant strides to align on certain aspects of crypto regulation, the potential for creating a unified global standard seems promising, and with it, a more reliable future for the cryptocurrency market.

Frequently Asked Questions

What are the key 2025 crypto regulation changes affecting investors?

The key 2025 crypto regulation changes include the implementation of the CLARITY Act in the US, which defines the roles of the SEC and CFTC, and the GENIUS Act, which establishes a federal framework for stablecoin issuers. These regulatory changes aim to protect investors by providing clear guidelines and improving market stability.

How do stablecoin regulations in 2025 impact the broader crypto market?

Stablecoin regulations in 2025, particularly under the GENIUS Act and the EU’s AMLA framework, are designed to standardize issuance and ensure that stablecoins meet strict reserve requirements. This helps foster trust and stability in the crypto market, making stablecoins a safer option for investors and paving the way for their broader adoption.

What is the significance of global crypto laws in 2025?

Global crypto laws in 2025, including the MiCA framework in the EU and stablecoin regulations in various jurisdictions, represent a significant step in creating coherent guidelines for crypto assets. These laws aim to enhance compliance and operational standards while reducing risks associated with crypto trading, thus fostering a more secure and regulated market environment.

What does crypto asset compliance look like under the 2025 regulatory framework?

Under the 2025 regulatory framework, crypto asset compliance involves adherence to centralized rules governing the issuance and management of digital currencies, including stablecoins. This includes following guidelines set by regulators like the SEC and CFTC in the US, and EBA opinions in the EU, ensuring that crypto firms maintain operational integrity and protect consumer interests.

How does the introduction of a digital dollar affect 2025 crypto regulations?

The introduction of a digital dollar, defined under the new regulatory frameworks, affects 2025 crypto regulations by providing a clear structure for issuance and governance. It sets a precedent for how digital currencies can interoperate within the traditional financial system, facilitating smoother integration into existing payment infrastructures.

What is the role of the SEC and CFTC in 2025 crypto regulations?

In 2025, the SEC and CFTC play crucial roles in establishing regulatory frameworks for cryptocurrencies and digital assets. The CLARITY Act helped delineate their responsibilities in overseeing crypto markets, ensuring that securities laws apply where necessary and providing clearer guidelines for compliance by crypto asset companies.

How will the 2025 regulations affect the taxation of crypto assets?

The 2025 regulations, particularly the IRS Staking Safe Harbor Guidance, clarify the tax implications of crypto activities like staking. This guidance sets clear expectations for how crypto assets will be treated for tax purposes, helping investors and companies understand their compliance obligations.

What transformation has occurred in stablecoin regulation in 2025?

In 2025, stablecoin regulation has transformed significantly, with major frameworks like the US GENIUS Act and the EU’s comprehensive assessments addressing issuance criteria and risk management. These regulations promote stability and accountability in the stablecoin market, fostering confidence among investors and users alike.

What are the anticipated impacts of 2025 crypto regulations on institutional investors?

The 2025 crypto regulations are expected to significantly impact institutional investors by providing a regulated framework that enhances trust and stability. The shift towards clearer compliance standards and secure custody measures will likely encourage more institutional capital to enter the crypto market.

How does the 2025 regulatory landscape affect the future of crypto investment?

The 2025 regulatory landscape is poised to enhance the future of crypto investment by establishing a more structured and secure environment for both retail and institutional participants. As regulations clarify roles and responsibilities, investor confidence is likely to grow, facilitating broader adoption and innovation within the crypto space.

| Region | Regulation | Description | Effective Date |

|---|---|---|---|

| United States | CLARITY Act | Clarifies SEC and CFTC regulatory roles | January 2025 |

Summary

In 2025, crypto regulations have transformed the landscape of the digital currency market, marking a significant shift in how cryptocurrencies are governed. The comprehensive 2025 crypto regulations aim to provide clarity and stability to market participants by defining roles, enhancing compliance measures, and establishing structured frameworks. This evolution reflects a growing recognition of the need for effective regulation to protect investors and support the legitimacy of the crypto market.